Posted April 16, 2025

By Davis Wilson

100% Success Rate Buy Signal

Can you name a stock market indicator that has a perfect track record?

I’m talking about an indicator that every single time it’s flashed, stock prices have been higher 1, 2, 3, 4, and 5 years later.

Can you name it?

The answer is the CBOE Volatility Index, otherwise known as the VIX.

Recently, the VIX closed above 50 for the first time since April 2020, a rare event that has historically been a golden signal for long-term investors.

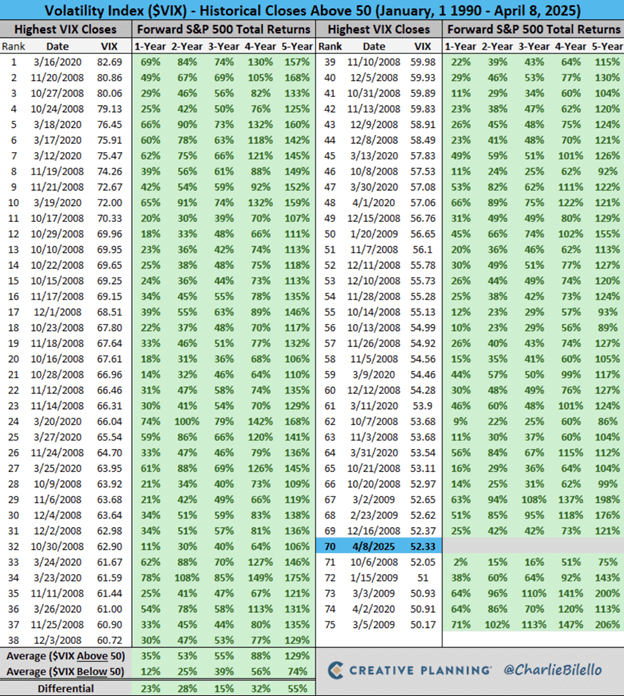

Data shows that every single time the VIX has closed above 50 since 1990 – a perfect track record spanning 75 occurrences – the S&P 500 has been higher 1, 2, 3, 4, and 5 years later.

With the market still reeling from a recent selloff, this could be a prime moment to buy stocks at bargain prices.

Let’s explore what the VIX is and why its perfect track record above 50 makes it a compelling buy signal.

Introducing: The VIX’s Perfect Track Record

The VIX measures the market’s expectation of volatility over the next 30 days, derived from the implied volatility of S&P 500 index options.

In simpler terms, it reflects how much investors expect the market to swing, serving as a barometer of fear and uncertainty.

A low VIX, typically between 10 and 20, indicates calm markets and investor confidence.

A high VIX, especially above 30, signals growing unease, often coinciding with sharp declines in stock prices.

When the VIX crosses 50, as it did last week, it reflects extreme panic – a level seen only during major crises like the 2008 financial meltdown or the 2020 COVID-19 crash.

As you can see in the chart above, the VIX has closed above 50 on 75 occasions, and each time, the S&P 500 has delivered positive returns over the following 1, 2, 3, 4, and 5 years – 100% of the time.

The average gains are staggering: 35% after 1 year, 53% after 2 years, 55% after 3 years, 88% after 4 years, and 129% after 5 years.

Why does this happen?

When the VIX spikes above 50, it typically reflects widespread panic, with investors selling stocks indiscriminately.

This fear-driven selling pushes prices down, often below their intrinsic value, creating a buyer’s market.

High-quality stocks – companies that I frequently discuss here at The Million Mission – get dragged down with the broader market, offering a rare chance to buy at a discount.

But as fear subsides and the market stabilizes, stock prices recover, rewarding patient investors who bought during the chaos.

The VIX’s perfect track record above 50 underscores this pattern: extreme volatility has always been a precursor to long-term growth.

Here’s What to Do Next…

Of course, while the VIX’s track record is flawless, it’s worth noting that past performance isn’t a guaranteed predictor of future results.

The data spans from 1990, so it doesn’t capture earlier market periods that might have behaved differently.

Still, the consistency of this signal is hard to ignore.

For investors, the message is clear: a VIX above 50 has historically been a buy signal you don’t want to miss.

At The Million Mission, I’m always on the lookout for such opportunities, and this is one of them.

So, what’s next?

The VIX is no longer above 50, so investing today won’t necessarily yield the same results as described in the chart above.

But the current market volatility is far from over.

The trade war driving much of this uncertainty will likely heat up again after the 90-day truce.

As tensions escalate with new tariffs and retaliatory measures, volatility could surge once more, potentially pushing the VIX above 50 once again.

When it does, don’t panic. Buy.

History shows that these moments of fear are the best times to invest for the long haul.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

My Perfect Portfolio - Major Changes

Posted January 14, 2026

By Davis Wilson

Trump + Bernie Sanders = RUN!

Posted January 12, 2026

By Davis Wilson

![[CES Las Vegas] 150,000 People + The Best Investments](http://images.ctfassets.net/vha3zb1lo47k/6ndLVzmV8iv1Kgpbfavg8D/082f21c83836c7e69673d6feec09fa95/shutterstock_2504318297__1_.jpg)

[CES Las Vegas] 150,000 People + The Best Investments

Posted January 10, 2026

By Davis Wilson

![[Exclusive] My Interview with a Quantum Exec.](http://images.ctfassets.net/vha3zb1lo47k/3UYc4HXc9PHtSbMsv1Wcto/ea4f48860898eaf28c3b83a04ed02b7a/mis-01-09-26-featured.jpg)

[Exclusive] My Interview with a Quantum Exec.

Posted January 09, 2026

By Davis Wilson

Live from Las Vegas – Amazon’s Next BIG Move

Posted January 07, 2026

By Davis Wilson