Posted October 13, 2025

By Davis Wilson

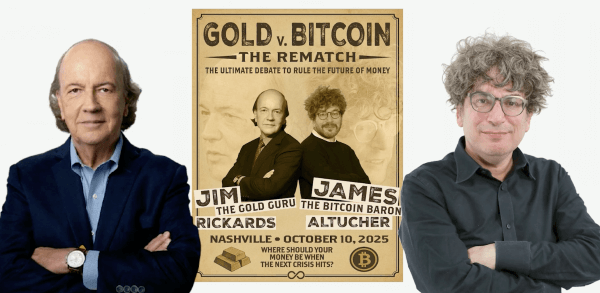

Altucher vs Rickards: The Rematch 7 Years In the Making

On Friday, more than 700 attendees gathered in Nashville for the debate of the decade: Jim Rickards vs. James Altucher – Gold vs. Bitcoin/crypto.

Rickards had won their first face-off back in 2018.

This time, the format was tighter and the stakes higher: seven rounds, each built around a single question.

After every round the audience voted on who made the stronger case.

James fiercely defended Bitcoin and crypto as the future of money while Jim made his case for gold as the only true store of value.

What followed wasn’t just a debate about assets.

It was a battle between two worldviews – one rooted in history and the other built on technology.

Question #1: If tomorrow we wake up to a banking freeze… which asset would you each prefer to own and why?

Jim Rickards took the first swing. He argued that most people think they have money in the bank but they really don’t.

“Try withdrawing $100,000,” he said.

“You’ll be told to come back in a few days with your birth certificate, passport, and a full explanation of what you plan to do with it. Maybe you’ll get it, maybe you won’t.”

Gold, Jim argued, has served as money for thousands of years. Bitcoin on the other hand “isn’t accepted anywhere outside of one coffee shop in Brooklyn.”

And if banks are closed good luck converting your Bitcoin into gold or dollars.

James Altucher countered that both gold and crypto exist to solve the same problem – banks.

“They pay you a fraction of what they earn on your money,” he said. “And they control the flow of capital through outdated wire systems.”

Crypto, James argued, was built for a banking freeze. “Your crypto isn’t held in a bank and gold is only legal tender in 11 states.”

Jim wins round one. Score: Jim: 1 – James: 0

Question #2: Would a coordinated government attack on either asset (ie. gold confiscation or crypto regulation) change your position? Why or why not?

James answered first: “Crypto was invented to avoid censorship from the government.”

He noted that even former President Trump was “debanked” by Bank of America.

“With crypto, you don’t need a bank. You can use cold storage or even offline transfers.”

Jim pushed back, saying the U.S. government can’t confiscate gold under the Fifth Amendment.

“In 1933, they compensated citizens fairly. Gold’s been a trusted store of value for millennia, unlike Bitcoin, which remains a haven for bad actors.”

James took round two. Score: Jim: 1 – James: 1

Question #3: In 10 years… do you believe the majority of global wealth preservation will be in gold, Bitcoin, or something else?

Jim said gold already holds the majority share.

He called Bitcoin’s 21 million cap its fatal flaw: “If the economy grows but Bitcoin’s supply stays fixed, deflation runs wild. You can’t have a reserve currency that causes chaos.”

James countered that demand drives price.

“Bitcoin’s fixed supply is the point. More demand, higher value.”

He noted $500 billion in crypto ETF inflows last year and predicted crypto’s share of global wealth will surge.

Jim wins round two: Jim: 2 – James: 1

Question #4: How would each asset perform in a deflationary shock versus an inflationary spiral?

James began: “Neither gold nor crypto are tightly correlated to the dollar. Both have around 0.5 correlation.”

He argued that crypto thrives in crises because it’s easy to move and borderless.

“Gold can’t be transferred easily. It’s heavy!”

Jim fired back with history: gold rose 75% during the 1930s deflationary period and more than 2,000% during the inflation of the 1970s.

“Gold wins in both scenarios.”

Jim wins this round. Score: Jim: 3 – James: 1

Question #5: What’s the biggest risk to owning the asset you’re advocating for?

Jim acknowledged gold’s long bear market from the 1980s to late 1990s when prices fell from over $600 to around $200 per ounce.

“A booming economy can hurt gold but at least you’d be making money elsewhere.”

James said the biggest risk for gold is that we don’t know how much exists.

“With Bitcoin, supply is transparent.”

He admitted crypto’s biggest risk is that adoption stalls, but pointed to $26 trillion in stablecoin transactions last year versus $15 trillion for Visa.

“The train’s left the station.”

James wins this round. Score: Jim: 3 – James: 2

Question #6: If you each had to allocate $100,000 of your own money today between gold and Bitcoin… what percentage would you assign to each and why?

James didn’t hesitate: “100% Bitcoin, 0% gold.”

He said it’s not because gold will crash. He just believes crypto is the future.

“At gold conferences, the median age is 90. At crypto conferences, it’s 25.”

He also noted that his employees around the world prefer getting paid in crypto.

Jim gave the exact opposite answer: “100% gold.”

He cited an MIT study showing 90% of Bitcoin is owned by a handful of whales who manipulate the market.

“If this were stocks they’d be in jail.”

James wins this round. Score: Jim: 3 – James: 3

Question #7: What is your prediction for gold and Bitcoin prices in 2030?

Jim went big: “$30,000 per ounce for gold.”

He said as gold’s price rises the swings will only get larger.

“As for Bitcoin, take your pick – $200,000, $300,000 – on its way to zero.”

James stuck to his famous 2018 prediction: “Bitcoin will hit $1 million.”

He cited crypto’s explosive adoption, stablecoin growth, and expanding utility.

James wins the final round. Score: Jim: 3 – James: 4

James Altucher and Bitcoin win in comeback fashion.

James was awarded a golden trophy, which prompted Jim to quip, “Notice how that trophy’s made of gold and not Bitcoin.”

As for me – I suggest owning some of both yourself.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

$600 → $87: A Valuable Lesson About Bubbles

Posted December 03, 2025

By Davis Wilson

Google Gemini + TPU → The Case for GOOG $3.8T

Posted December 01, 2025

By Davis Wilson

The NVDA Trade… Bitcoin… AI

Posted November 29, 2025

By Davis Wilson

The Strange Anomaly I’m Thankful For

Posted November 28, 2025

By Davis Wilson

Turkey & Drama: How To WIN Arguments on Thanksgiving

Posted November 26, 2025

By Davis Wilson