Posted October 27, 2025

By Davis Wilson

Calendar Reminder: AI Bubble (Wednesday, October 29)

Are we in an AI bubble?

We’ll find out this week.

Wednesday and Thursday will likely determine the direction of the entire U.S. stock market for the rest of the year.

That’s when Big Tech steps into the earnings spotlight.

Microsoft, Alphabet, and Meta report on Wednesday while Apple and Amazon follow on Thursday.

These aren’t just the biggest companies in the S&P 500. They’re the core of the AI revolution.

These are the firms building, training, and deploying the world’s most advanced models.

And their spending plans will likely dictate the direction of the market for the rest of the year.

The Unprecedented Spending Spree

Here’s where we are: Four major tech firms – Microsoft, Alphabet, Meta and Amazon – are expected to invest over $300 billion this year in AI infrastructure, primarily on GPUs from Nvidia and the data-center capacity to host them.

Here’s the breakdown:

- Microsoft said in July it expected to spend $30 billion in capital expenditures during the quarter, representing annual growth of more than 50%.

- Alphabet raised its full-year capex outlook to $85 billion, up from $75 billion.

- Meta boosted the midpoint of its 2025 capex forecast by $1 billion to $69 billion.

- Amazon plans to spend over $100 billion this year, signaling capex of about $31 billion per quarter in the second half.

It’s a staggering level of investment that shows no signs of slowing.

Still, there’s an important caveat: this AI spending spree far outpaces the current revenue these companies are generating from AI today.

Investors are essentially front-running the payoff, assuming this massive investment will eventually translate into dominance once the technology matures.

That level of upfront spending is making some investors uneasy, evoking echoes of the dot-com era as the market waits to see if these bets will pay off.

Coming Soon: The Next Phase of AI

While some are calling it a bubble, I see it differently.

The AI buildout is far from over.

Right now, we’re in the training phase, where models like ChatGPT and Gemini are learning from massive datasets.

This phase is compute-intensive, but it’s just laying the groundwork for everything that comes next.

The next wave is inference. This is when AI models like ChatGPT and Gemini are put to work in the real world, running constantly in apps, websites, and devices to answer questions, make recommendations, or automate tasks.

Training a model requires enormous compute power. But inference requires significantly more.

Analysts estimate that inference could demand 5-10X more compute than training once AI is fully embedded into everyday tools and devices.

And that’s just the beginning.

The phase after inference is physical AI, where intelligent systems move beyond screens into robots, vehicles, and machines that operate in the physical world.

These applications will require even more data centers, GPUs, and power infrastructure.

Estimates say physical AI (robots, autonomous vehicles, drones, etc.) will require 10–50X more compute than training depending on scale and complexity.

So no, I don’t think we’re in an AI bubble.

I think we’re in a bubble of people talking about a bubble.

The foundation of this new computing era is still being built and the companies funding it are just getting started.

I’m a holder of Nvidia and other large-cap tech names in my personal portfolio.

I’m not selling.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The $6 Trillion Sweater, NAK, and Don Jr.!

Posted November 01, 2025

By Davis Wilson

How About a Friendly Wager?

Posted October 31, 2025

By Davis Wilson

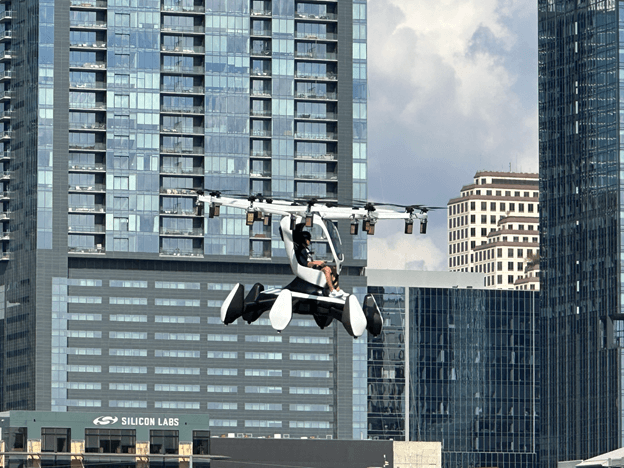

Flying Cars… Pebble Mines… and The Whiskey Bar

Posted October 25, 2025

By Davis Wilson

My Experience Test Piloting a “Flying Car”

Posted October 24, 2025

By Davis Wilson

To Short Squeezes and Beyond(Meat)!

Posted October 22, 2025

By Davis Wilson