Posted June 09, 2025

By Davis Wilson

ChatGPT Returns 650% – Here's How to Copy It

You may not be an Ivy League research analyst with access to a $25,000-a-year Bloomberg terminal…

But what if you had something better – an AI stock picker that could outperform the pros using nothing but headlines, data, and a little reasoning?

That’s the question Alejandro Lopez-Lira, a finance professor at the University of Florida, has spent the last few years exploring.

With tools like ChatGPT, Grok, and DeepSeek at his fingertips, Lopez-Lira wanted to know: Can artificial intelligence actually pick winning stocks?

Turns out, it can.

The First Experiment: Backtesting GPT on News Headlines

Lopez-Lira began his AI investing journey in late 2022, shortly after OpenAI launched ChatGPT.

He ran a study using ChatGPT to interpret over 134,000 stock-related headlines.

Each day, the AI would label each headline as good, bad, or neutral for a stock.

If it was good, it simulated a buy. If bad, it simulated a short. Neutral? No trade.

To prevent hindsight bias, he only used headlines from after September 2021, the cutoff date for ChatGPT’s training data.

This forced the model to reason – rather than “remember” – how a stock might react.

The results were staggering: a simulated daily return of 0.38%, which compounded to more than 650% over 26 months.

A big chunk of the performance came from shorting stocks with negative headlines.

Was it perfect? No.

The backtest didn’t account for real-world frictions like taxes, short interest fees, or trading costs.

But it was impressive enough for Lopez-Lira to take the idea out of the lab and into the market.

Round Two: Investing Real Money With AI

In 2023, Lopez-Lira teamed up with the Autopilot app to start live-testing AI-generated portfolios.

He used ChatGPT to pick stocks using real-time financial data, macro headlines, and pricing information.

He later added Grok and DeepSeek to the experiment.

Each model was given the same data and asked to build a 15-position portfolio.

The AIs were allowed to decide their own mix of assets and even allocate weights.

The only limits? No leverage, no short positions, and no derivative-based ETFs.

Here’s what each AI picked for the volatile April 1, 2025 to May 5, 2025 cycle:

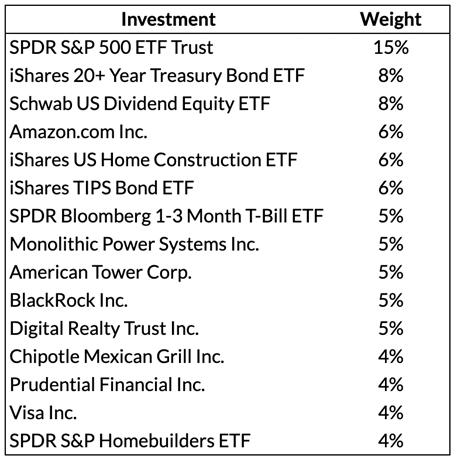

OpenAI’s GPT-4 (o1 pro) Portfolio Picks

Strategy: Broad market exposure, tech giants, and stable dividend payers.

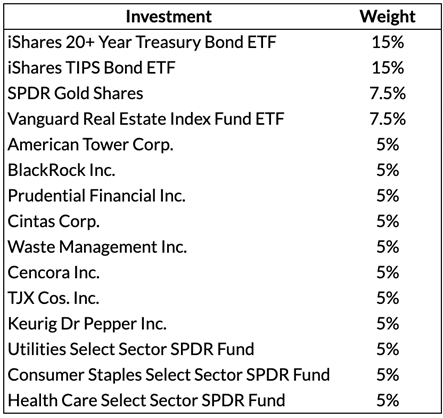

Grok 3 Portfolio Picks

Strategy: Defensive and yield-focused with heavy Treasury exposure. Grok leaned into safety ahead of potential economic softness.

DeepSeek R1 Portfolio Picks

Strategy: Blue-chip stocks with defensive traits. A “stay in the game” strategy in volatile conditions.

So, Should You Trust AI With Your Money?

Lopez-Lira is the first to admit that these tools still need oversight.

They don’t access real-time data by default, and their decisions are only as good as the information they’re fed.

But the early results are promising:

- Lopez-Lira began managing ChatGPT’s portfolio in September 2023. The returns are 43.5% from September 2023 to May 30, 2025 while the S&P 500 had a total return of 34.7% over the same period.

- Grok’s portfolio returned 2.3% since its inception on Feb. 11 of this year through May 30. The S&P 500 had a total return that was down 2.2% over the same period.

- DeepSeek was down 0.25% since its inception on Feb. 3 through May 30. The S&P 500 had a negative total return of 0.93% for the same period.

You can invest alongside these portfolios yourself on the Autopilot app.

[Note: We do not have any affiliation with Autopilot.]

As AI keeps improving, it won’t be long before investors without fancy credentials or six-figure salaries can compete with Wall Street.

No PhD required – just a smart prompt.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

NEW Senate Bill: Crypto Clarity... FINALLY!

Posted June 25, 2025

By Davis Wilson

"Stablecoins" 3...2...1...Liftoff

Posted June 23, 2025

By Davis Wilson

A 68-Year-Old Investor. A $25K Dilemma. A Real Answer.

Posted June 21, 2025

By Davis Wilson

Stablecions Saved My Friend $120,000

Posted June 20, 2025

By Davis Wilson

The Mainstream Media Won’t Tell You This

Posted June 18, 2025

By Davis Wilson