Posted April 21, 2025

By Davis Wilson

Davis’ Perfect Portfolio

Today, building a portfolio that can weather turbulence while delivering strong returns is more important than ever.

After careful analysis, I’ve curated my “Perfect Portfolio.”

This is a selection of five assets I believe will significantly outperform the broader stock market over the next 3-5 years: Nvidia, Uber, Meta, Alphabet, and Bitcoin.

These are all stocks I’ve previously written about here in The Million Mission.

They combine exposure to high-growth sectors like AI, autonomous mobility, and digital platforms, alongside a hedge against traditional markets with Bitcoin.

Here’s why I’m confident in this portfolio for the next 3-5 years.

1. Nvidia (NVDA): The AI Powerhouse

Nvidia remains a cornerstone of my portfolio despite its recent selloff and $5.5 billion write-down due to China tariffs.

This dip, which shaved over $1 trillion off its market cap, presents a buying opportunity.

Nvidia is the leader in AI chips, a sector expected to grow exponentially as industries adopt generative AI and machine learning.

Despite the China setback, it’s important to know that this AI revolution is just getting started.

Over the next few years, several transformative technologies will increasingly rely on Nvidia’s chips, further solidifying its growth trajectory.

For example, the rise of autonomous vehicles will depend heavily on Nvidia’s DRIVE AGX platform. Advancements in quantum computing will continue to rely on Nvidia’s CUDA-Q platform. And the metaverse and spatial computing sectors will lean heavily on Nvidia’s GPUs for rendering high-fidelity graphics and AI-driven interactions.

If you don’t already own this stock, I highly recommend you start buying at these low prices.

Uber Technologies (UBER): A Bet on Autonomous Mobility

Uber may have started as a simple ride-hailing service, but today it's a global mobility platform with a footprint in food delivery, freight logistics, and increasingly, autonomous transportation.

What excites me most about Uber isn’t just what it is today – it’s what it could become tomorrow.

Autonomous vehicles (AVs) represent a once-in-a-generation shift in mobility, and Uber is positioned to be a major beneficiary.

Why? Because the biggest cost in an Uber ride today is the driver, accounting for roughly 70% of the fare.

Removing that cost could dramatically increase margins, lower prices for riders, and boost profitability across the board.

While Uber isn’t building its own AV tech anymore (it sold off its in-house division in 2020) it’s taking a smarter path: partnering with the best.

Uber’s collaborations span industry leaders like Waymo, Aurora, WeRide, Avride, and even BYD, allowing it to remain the connective tissue of the ride-hailing world while these companies focus on hardware and AI.

These partnerships are already bearing fruit: thousands of autonomous rides are completed daily in cities like San Francisco, Phoenix, Austin and more.

Despite the long-term promise, Uber’s stock has stagnated with the rest of the market – down from its highs of $87 – mostly due to fears about Tesla’s robotaxi ambitions and Waymo partnering with a different platform in Miami.

But the idea that one company will dominate AVs overnight is misguided.

This is a massive, global transition with room for multiple winners. And Uber, with its unmatched platform, brand, and real-time routing data, will be one of them.

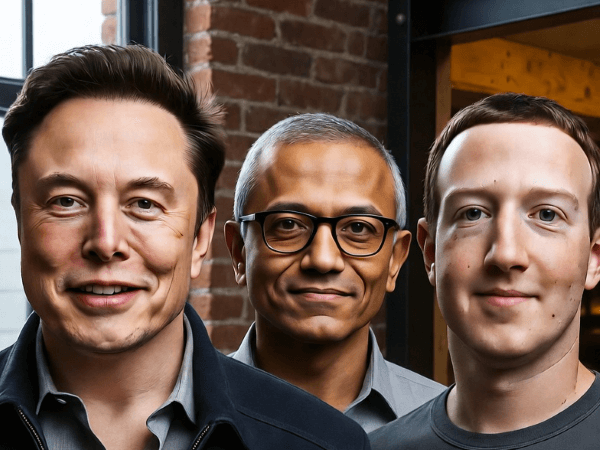

3. Meta (META): The Social Media and AI Play

I’ve held Meta since 2022 and still see it as a top pick for the years ahead – especially at today’s valuation.

With a current P/E of 20 and a forward P/E of just 17, Meta is remarkably cheap for a company of its scale, reach, and profitability.

Nearly half the world interacts with a Meta-owned platform every day, with Facebook, Instagram, and WhatsApp combining for 3.29 billion daily active users.

That kind of engagement is almost impossible to replicate and makes Meta the dominant player in digital advertising.

This translates into better AI-driven ad targeting that delivers better performance for marketers and higher returns for shareholders.

And while many of its competitors are still struggling to monetize their AI technologies, CEO Mark Zuckerberg has made it clear that AI is already improving nearly every part of the business.

For investors looking for scale, profitability, and long-term upside, Meta is still one of the best buys in the market.

4. Alphabet (GOOG): An Undervalued Tech Titan

Alphabet (GOOG) is one of the best deals in the market right now.

You’re getting world-class businesses like Google Search, YouTube, Google Cloud, and Android – all under one roof – for just 18x earnings and 15x forward earnings.

This is well below the S&P 500’s valuation despite stronger margins, growth, and moats.

Search is still a cash-printing machine, YouTube dominates digital video, and Cloud is rapidly gaining share in one of tech’s fastest-growing sectors.

On top of that, Alphabet is investing heavily in AI and automation, areas that will define the next decade.

The company also sits on over $100 billion in cash, buys back billions in stock each quarter, and continues to grow earnings at a double-digit clip.

5. Bitcoin (BTC): The High-Risk, High-Reward Outlier

Bitcoin is a core holding in my portfolio, and I plan to hold it indefinitely – a conviction shaped by my previous career in venture capital.

In VC, my job was to identify and invest in high-potential startups, much like a “shark” on Shark Tank.

That experience fundamentally changed how I approach investing, especially in high-risk assets like Bitcoin.

In venture capital, portfolios follow a Power Law distribution: out of 100 investments, 60 may fail completely, most linger in the middle, but 1-2 outliers can deliver 50X, 100X, or even 2,000X returns.

I’ve seen this firsthand at a VC fund where our best investments returned over 2,000X.

The lesson?

The risk of missing an outlier far outweighs the risk of losing on most bets.

Bitcoin, love it or hate it, fits this outlier profile.

My Perfect Portfolio

This portfolio is not about safety. It’s about conviction and concentration.

It’s designed to significantly outperform the S&P 500 over the next three years.

Will there be volatility? Without a doubt.

But this portfolio is stacked with:

- Dominant business models

- Huge tailwinds

- Clear growth paths

- And attractive entry points right now

I’m not saying you should sell everything else and go all in.

But if you’re looking to build a high-growth, high-upside portfolio for the next market cycle, I believe these five names are a great place to start.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Don’s Dumb -$3,500 Bitcoin Mistake

Posted February 09, 2026

By Davis Wilson

Market Drop + PLTR, Uber & FNMA Q&A

Posted February 07, 2026

By Davis Wilson

Slaughterhouse Software

Posted February 06, 2026

By Davis Wilson

Ticker: ELON - $1.25 Trillion in PROOF

Posted February 04, 2026

By Davis Wilson

The Wilson Family's WORST Investment Mistake

Posted February 02, 2026

By Davis Wilson