Posted October 29, 2025

By Davis Wilson

Do or Dye: Crucial Lesson From "Dr. Doom"

Tony Dye was one of Britain’s best-known fund managers in the late 1990s.

He was the chief investment officer at Phillips & Drew, one of Britain’s largest asset managers at the time.

He earned the nickname “Dr. Doom” because he spent years warning that stock markets were overvalued and headed for a crash.

In 1995, as the FTSE 100 neared 4,000, Dye began shifting client money out of equities and into cash.

It was a bold move… and for years, it looked like a terrible one.

Tech stocks exploded higher and the internet boom turned small investors into millionaires.

Meanwhile, Dye’s funds lagged far behind.

By 1999, the firm was ranked 66th out of 67 for performance amongst Britain's institutional fund managers and was haemorrhaging clients.

in early 2000 – just weeks after the FTSE broke 7,000 for the first time – Tony Dye was fired.

Days later, he was vindicated.

The dot-com bubble burst.

Over the next three years, global markets lost more than half their value.

Dye had been right. But being right too soon cost him everything.

That story holds an important lesson for investors: Timing is everything. And it cuts both ways.

Today, coincidentally enough is the anniversary of another bubble, the 1929 Stock Market Crash.

Yet the same fundamental question asked back then and by Tony Dye in the late 1990s hangs over the market again: are we in a bubble?

This time, the fear centers on artificial intelligence.

The biggest companies in the world – Microsoft, Alphabet, Amazon, and Meta – are collectively spending over $300 billion this year on data centers, GPUs, and AI infrastructure.

Nvidia has become the most valuable chipmaker in history.

Stocks tied to AI have skyrocketed.

Skeptics argue that valuations have run too far too fast.

All this investment can’t possibly be justified by current AI revenues. We’re due for a reckoning.

I hear those arguments. But I think we’re living through something far different than the dot-com era.

In 1999, most internet companies had no revenue, no real business model, and no clear path to profitability.

The bubble was built on dreams, not data.

Today, the money is going into hard assets – GPUs, servers, data centers, energy grids.

These aren’t banner ads and press releases. They’re the physical foundation of a new computing age.

Yes, AI stocks have run up quickly.

But if this truly is the next major technological platform shift then being early is exactly where you want to be.

Because in every major bull market, the early believers always look foolish before they look brilliant.

(Just ask James Altucher)

Yes, Tony Dye was right about the crash.

But he missed 5 years of the greatest wealth building opportunity in history and likely the next two decades of wealth creation that followed in survivors like Google, Apple, and Amazon.

That’s the irony of investing.

Being right too soon still feels a lot like being wrong.

And right now, I’d rather be early to the biggest technological transformation of our lifetime than late to the party.

That’s why I’m staying long AI.

Nvidia. The hyperscalers. The infrastructure builders.

This isn’t the end of the bull market.

The foundation is just being poured.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The $6 Trillion Sweater, NAK, and Don Jr.!

Posted November 01, 2025

By Davis Wilson

Calendar Reminder: AI Bubble (Wednesday, October 29)

Posted October 27, 2025

By Davis Wilson

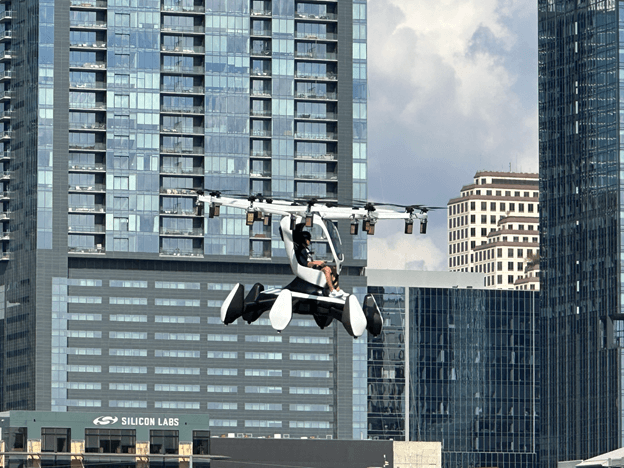

Flying Cars… Pebble Mines… and The Whiskey Bar

Posted October 25, 2025

By Davis Wilson

My Experience Test Piloting a “Flying Car”

Posted October 24, 2025

By Davis Wilson

To Short Squeezes and Beyond(Meat)!

Posted October 22, 2025

By Davis Wilson