![[Exclusive] My Interview with a Quantum Exec.](http://images.ctfassets.net/vha3zb1lo47k/3UYc4HXc9PHtSbMsv1Wcto/ea4f48860898eaf28c3b83a04ed02b7a/mis-01-09-26-featured.jpg)

Posted January 09, 2026

By Davis Wilson

[Exclusive] My Interview with a Quantum Exec.

Yesterday, I spoke with Dr. Pouya Dianat, the Chief Revenue Officer of Quantum Computing Inc. (QUBT), for an exclusive interview.

Quantum computing has become one of the hottest themes in the market.

Money is flowing into quantum stocks fast.

Yet most investors are buying these stocks without knowing what quantum actually is.

That gap between capital and comprehension is where mistakes get made.

Rather than speculate from the outside, I wanted answers from the executive responsible for selling quantum technology to real customers in the real world.

So I started with the most basic question:

Question #1: How do you best describe quantum computing to someone who knows nothing about the technology?

Dr. Dianat explained that traditional computers work in a linear way.

They process information step by step, testing one possible answer at a time.

That approach works extremely well for everyday tasks like email, spreadsheets, and web browsing.

Quantum computers are different.

They are designed to explore many possible outcomes at the same time.

That makes them useful for problems where the number of inputs and possibilities becomes too large for classical computers to handle efficiently.

James Altucher calls this the “finding the tiger” problem.

Imaging you’re in a building with 1,000,000 doors and hiding behind one of them is a tiger.

How do you find that tiger?

With a regular computer, you have to open each door one at a time.

With a quantum computer, you can open them up all at the same time and instantly find the tiger.

For that reason, it can be billions of times faster than a regular computer.

This is why quantum is expected to be extremely useful in complex industries like drug discovery and investing – where there are thousands of factors that all need to be considered simultaneously.

Question #2: Can quantum actually solve real-world problems today? Or is this still theoretical?

It can solve real problems today, but with important limits.

Most current applications are experimental or hybrid, meaning they combine classical computing with quantum techniques.

You see this in research labs, advanced simulations, and early pilots.

A good analogy is early aviation.

Planes could fly, but they weren’t reliable enough to move millions of people every day.

Quantum is at a similar stage.

The technology works, but it’s not ready for widespread commercial use yet.

For that, we’ll likely have to wait for the 2030s.

Question #3: If we’re years away from widespread commercial use, why have quantum stocks suddenly gotten so much attention?

Dr. Dianat understands the emotional forces that drive markets because he feels them too.

He invests personally and knows how quickly excitement can overwhelm fundamentals.

In his view, the recent surge in quantum stocks is less about technological breakthroughs and more about one powerful emotion: the fear of missing out.

Many investors arrived late to the AI boom, only investing after the easy gains were gone.

Now those same investors are looking for the next “AI-like” opportunity.

Quantum computing fits that narrative perfectly.

It sounds revolutionary, it’s still early, and it offers the psychological comfort of getting in before everyone else.

That doesn’t mean the technology suddenly matured overnight.

It means expectations are racing far ahead of reality.

Question #4: What’s keeping quantum from widespread use?

I actually posed this question to an engineer during a live demonstration.

He explained that quantum technology is incredibly fragile because it uses qubits instead of the normal bits found in today’s computers.

A regular bit is simple. It’s either a 0 or a 1.

A qubit is different. It can exist in a mix of 0 and 1 at the same time.

The catch is that the machines being used to make this possible must be kept at extremely cold temperatures and isolated from vibration and electrical noise.

Even a tiny disturbance can cause the calculation to collapse or produce errors.

So the technology is powerful in theory and works in controlled experiments.

But making it stable, reliable, and scalable enough for everyday use is still the hard part.

Question #5: Are all quantum companies taking the same approach?

Dr. Dianat: Not at all. There are many ways to build quantum technology.

Some companies, including large players like IBM and IonQ, are pushing hard to build fully scaled, fault-tolerant quantum hardware as fast as possible.

That’s like trying to build a race car from day one.

QUBT is taking a different path.

They're starting with training wheels. Then building a bike. Then eventually they'll build the car.

In practical terms, that means QUBT is focusing on software, tools, and near-term solutions that can deliver value before perfect quantum hardware exists.

Dr. Dianat believes that’s the best path. But there are multiple ways to build this technology.

Question #6: QUBT and other quantum companies already report revenue. What should investors understand about that?

This is where nuance matters.

Yes, there is revenue.

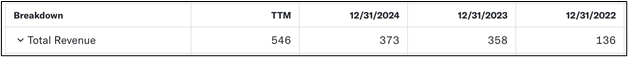

Here’s QUBT’s revenue over the last few years (in thousands, meaning $373,000 in 2024):

But most of this revenue comes from early adopters, research institutions, and organizations that want to stay up to date on new technologies.

These customers are experimenting and preparing, not rolling quantum out across their business.

That’s very different from broad enterprise adoption.

Revenue today tells you there is interest.

It does not mean quantum is ready for mass deployment.

Here’s the Takeaway

This conversation made one thing very clear.

Quantum computing is real.

But it is also early, fragile, and still impractical at scale for most businesses.

Dr. Dianat was explicit about the timeline.

Widespread commercial use is more likely a 2030s story, which in stock market terms is an eternity away.

Between now and then, we will almost certainly see recessions, geopolitical shocks, and multiple market cycles.

There will also be other technological breakthroughs that capture attention and capital long before quantum reaches broad adoption.

That perspective matters.

There is no need to rush into the quantum hype by buying stocks today simply because the story sounds early or exciting.

Quantum will have its moment. It just is not yet.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

My Perfect Portfolio - Major Changes

Posted January 14, 2026

By Davis Wilson

Trump + Bernie Sanders = RUN!

Posted January 12, 2026

By Davis Wilson

Live from Las Vegas – Amazon’s Next BIG Move

Posted January 07, 2026

By Davis Wilson

The REAL Venezuela Trade w/ Tickers

Posted January 05, 2026

By Davis Wilson

“Am I Crazy?”

Posted January 03, 2026

By Davis Wilson