Posted October 25, 2025

By Davis Wilson

Flying Cars… Pebble Mines… and The Whiskey Bar

Thank you for sending in questions and feedback!

These Saturday Q&As are where I clarify any loose ends and answer questions directly from readers.

So if you’re following The Million Mission, I recommend reading these Q&As closely.

Let’s get to it.

We’ve been hearing about “flying cars” for decades! Is this time supposed to be different?? – Martin

Fair question, Martin. And I understand the skepticism!

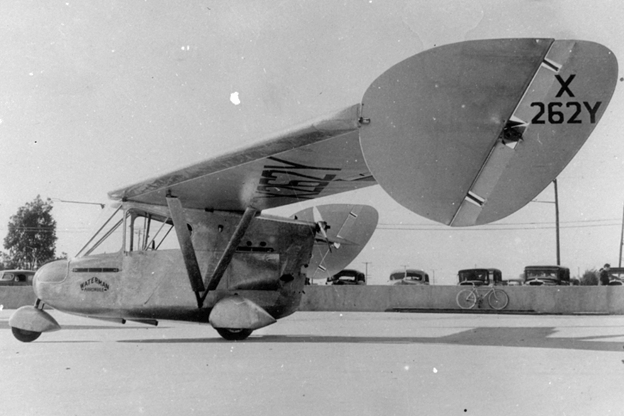

Here’s one of the earliest versions of a flying car back in 1937. This one was called the Arrowbile, which featured a 100-hp Studebaker engine and successfully flew from California to Ohio.

And here’s the AVE Mizar from 1973, which combined a Ford Pinto with the wings and engine of a Cessna Skymaster. Unfortunately the vehicle crashed on its second flight, killing both pilots.

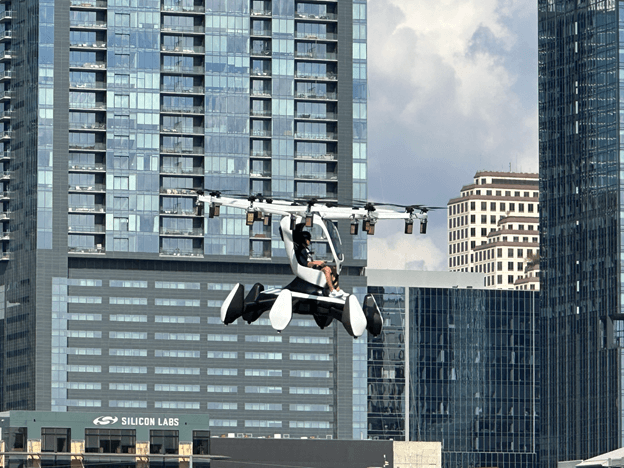

The difference this time is that the technology is mature, the costs are coming down, and regulators are finally getting on board.

Trump’s pro-innovation stance is helping too, especially through the Electric Vertical Takeoff and Landing Integration Pilot Program. On top of that, the FAA now has a leader with real eVTOL experience.

From the regulator’s perspective – as Wisk CEO Brian Yutko recently put it:

“In 2023, airlines flew 30 million flights, carried billions of passengers, and had zero accidents. Zero. If the system wasn’t broken, what incentive do the regulators have to change it?”

That’s the mindset regulators have been working from. But as these aircraft continue proving their safety and reliability – something I witnessed firsthand this week – expect the FAA to open the door wider for innovation.

Shares of Northern Dynasty (NAK) have taken a beating this week. What’s your thought process holding on to this stock? – Steve

Good question, Steve. I’m still holding NAK because my thesis hasn’t changed and the tide finally seems to be turning in our favor.

After years of regulatory setbacks, momentum around U.S. resource independence is building which directly benefits projects like Pebble.

The stock’s already up more than 80% from my entry but there’s plenty of room for upside if the permitting process continues to move in the right direction.

At this stage, I view it as a high-risk, high-reward position with asymmetric potential.

I created a watchlist called Whiskey Bar 2026. I’m going to pick one of them and add it to my portfolio. Which would you invest in if you had to pick just one? – Mike

Great question, Mike! First off, I’ll say that I respect every one of these investors. They each know their respective industries cold – from crypto and cybersecurity to mining and AI infrastructure.

That said, I’d also bet that a portfolio of all these names would outperform the S&P 500 next year.

Why? Because this lineup is structured like a high risk, high reward venture capital portfolio. You don’t need all nine to hit. You just need one or two to break out and the whole basket can deliver outsized returns.

If I had to pick just one though… give me Ray Blanco’s SEALSQ Corp (LAES).

I enjoy your column. Any early word yet on where next year's conference will be held? – Steve

Thank you, Steve! No word on next year’s conference just yet. Stay tuned.

Where can I find your portfolio? – Jan

Below!

Important Update: Follow The Million Mission on Twitter/X

Big news: I just launched a Twitter/X account so you can follow along with The Million Mission in real time. If you want quicker insights, early reactions to breaking news, and a closer look at how I’m navigating the road to $1 million – this is where I’ll be.

Come hang out, ask questions, and follow the Mission as it happens @DavisPWilson.

Another Important Update: The Million Mission website is live!

I’ve gotten plenty of feedback regarding where to find previous alerts. Well, The Million Mission website is finally live and you can check out archived alerts here.

Portfolio Overview

Here’s what I’m currently holding in the Million Mission portfolio:

Fannie Mae (FNMA) – 2,500 shares @ $7.25/share.

Northern Dynasty (NAK) – 5,000 shares @ $1.11/share

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The $6 Trillion Sweater, NAK, and Don Jr.!

Posted November 01, 2025

By Davis Wilson

How About a Friendly Wager?

Posted October 31, 2025

By Davis Wilson

Do or Dye: Crucial Lesson From "Dr. Doom"

Posted October 29, 2025

By Davis Wilson

My Experience Test Piloting a “Flying Car”

Posted October 24, 2025

By Davis Wilson

To Short Squeezes and Beyond(Meat)!

Posted October 22, 2025

By Davis Wilson