Posted October 18, 2025

By Davis Wilson

FNMA, NAK, And a New Robotics Stock

Thank you for sending in questions and feedback!

I read every single email I receive. I hope this Saturday email can clarify any questions you may have.

Let’s get to it.

You recommend investing in both gold and Bitcoin. What percentage of a portfolio do you think should be in each? – Brian

That’s a great question. Everyone’s financial situation is different, so there’s no one-size-fits-all answer here.

Personally, I recommend keeping 5–10% of your investable portfolio in each.

Gold offers stability, protection against inflation, and tends to perform well when markets get shaky. Bitcoin (and other cryptos) give you exposure to innovation and long-term upside tied to the growing digital economy.

Both assets serve different purposes, but over time, each has proven to deliver strong returns for investors who stay patient and disciplined.

Is it still OK to buy FNMA and NAK stock or is it too late? – Sian

Thanks for the question! I bought FNMA back in February and NAK about three weeks ago. Both have performed very well since then.

Would I still recommend them today?

If you understand that these are high-risk, high-reward plays – yes.

The key catalysts for both are still in front of us. Your potential returns will look different since prices have moved higher, but I still see both stocks offering strong asymmetric upside.

I purchased Ethereum two months ago and it is still down almost 9%. When the heck is this Ethereum going to go UP??? – Fred

I get it, Fred! Ethereum’s recent action has tested a lot of investors’ patience.

After a big run earlier this year, it’s been consolidating as investors wait for the next catalyst.

But here’s the thing: Ethereum investors are often rewarded over the long term.

The network’s adoption, developer activity, and real-world use cases keep growing.

I own ETH myself and I’m not selling any time soon.

Are there any investments you heard in Nashville that you’re thinking about adding to your portfolio? – Susan

There were plenty of high-conviction ideas floating around Nashville. One that really caught my attention was Teradyne (TER) that was recommended by Ray Blanco.

It’s a robotics play that fits right into my wheelhouse – growth at a reasonable price (GARP).

Teradyne makes the testing equipment used in chips and also owns Universal Robots, which is a leader in collaborative robotics. It’s the kind of business quietly benefiting from the automation boom without the hype.

Definitely one I’m digging into right now.

Important Update: Follow The Million Mission on Twitter/X

Big news: I just launched a Twitter/X account so you can follow along with The Million Mission in real time. If you want quicker insights, early reactions to breaking news, and a closer look at how I’m navigating the road to $1 million – this is where I’ll be.

Come hang out, ask questions, and follow the Mission as it happens @DavisPWilson.

Another Important Update: The Million Mission website is live!

I’ve gotten plenty of feedback regarding where to find previous alerts. Well, The Million Mission website is finally live and you can check out archived alerts here.

Portfolio Overview

Here’s what I’m currently holding in the Million Mission portfolio:

Fannie Mae (FNMA) – 2,500 shares @ $7.25/share.

Northern Dynasty (NAK) – 5,000 shares @ $1.11/share

Special Shoutouts

A special shoutout to Jerri, James, Tony, and Art for the thoughtful emails this week. Thanks for being along for the mission.

It was a pleasure and I look forward to seeing you at future Paradigm events.

Talk to you on Monday.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The $6 Trillion Sweater, NAK, and Don Jr.!

Posted November 01, 2025

By Davis Wilson

How About a Friendly Wager?

Posted October 31, 2025

By Davis Wilson

Do or Dye: Crucial Lesson From "Dr. Doom"

Posted October 29, 2025

By Davis Wilson

Calendar Reminder: AI Bubble (Wednesday, October 29)

Posted October 27, 2025

By Davis Wilson

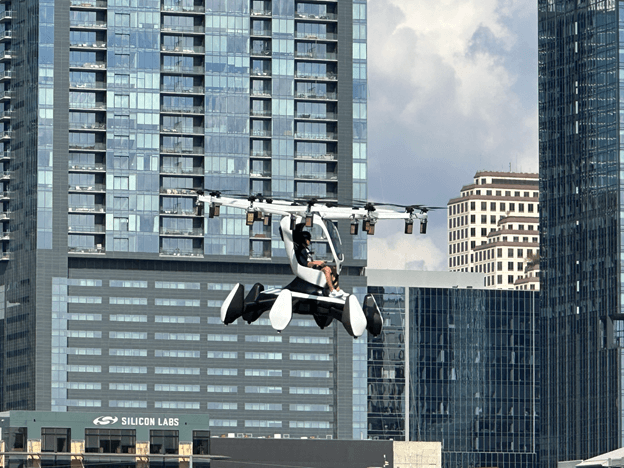

Flying Cars… Pebble Mines… and The Whiskey Bar

Posted October 25, 2025

By Davis Wilson