Posted May 23, 2025

By Davis Wilson

FNMA Surges 50% – And I’m Still Not Selling

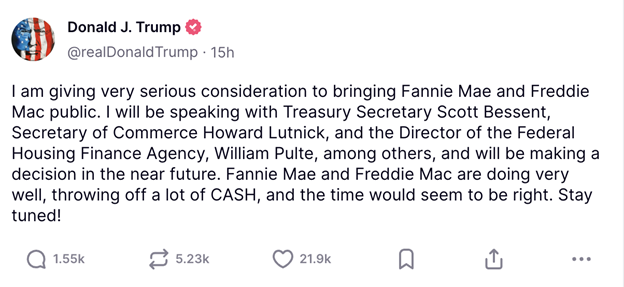

On Wednesday night, President Trump lit a fire under one of the most beaten-down corners of the market.

In a social media post, he said he's giving “very serious consideration” to bringing Fannie Mae and Freddie Mac public again – after over 15 years under government control.

Shares of Fannie Mae (FNMA) spiked over 50% yesterday. That jump alone pushed my position up more than $9,000.

But let me be clear: I’m not selling.

This isn’t the outlier event I bought FNMA for.

It’s a spark. But not the explosion I believe is still coming.

The Only Stock in My Portfolio

I started the Million Mission to find asymmetric trades – opportunities where the upside far outweighs the downside.

Fannie Mae is the one and only stock in my portfolio right now for exactly that reason.

Despite being in conservatorship since 2008, Fannie remains a central pillar of the U.S. housing market.

It’s profitable, mission-critical, and – if released from government control – could be worth multiples of its current price.

Let’s walk through why.

1. FNMA Is Still Wildly Undervalued

Last year, Fannie Mae generated $17 billion in net income on more than $30 billion in revenue.

That’s not a typo.

Yet its market cap currently sits around $11 billion – a little more than half of its annual profits.

Why?

Because nearly all of those profits are swept to the U.S. Treasury thanks to a 2012 rule called the “Net Worth Sweep.”

But with growing political and legal pressure, that may soon change.

If Fannie were released and allowed to retain its earnings like any normal company, the stock could rocket even higher.

Hedge fund manager Bill Ackman has laid out a base case price target of $39 per share – 4x higher than current levels.

2. Trump Just Reignited the Fuse

This week’s Trump post wasn’t just idle talk.

Reports from the Wall Street Journal confirm that his team has been working behind the scenes for months on a proposal to privatize the mortgage giants.

According to leaked plans, the government could raise $20–30 billion from new investors and retain a $250 billion stake.

That would make this one of the largest IPOs of all time.

Even if only a fraction of this plan moves forward, FNMA could rerate significantly.

3. This Is the Asymmetric Bet I’ve Been Waiting For

Could FNMA drop again if Trump walks back the comments or delays? Sure.

But I didn’t buy this stock for a quick pop.

I bought it for the once-in-a-decade dislocation between price and value.

I bought it because – when the tide finally turns – the revaluation could be dramatic.

The downside? Mostly time and patience.

The upside? A chance to 4x or more.

I’m staying the course. I planned this trade, and now I’m trading my plan.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

“sucking wind”

Posted January 16, 2026

By Davis Wilson

My Perfect Portfolio - Major Changes

Posted January 14, 2026

By Davis Wilson

Trump + Bernie Sanders = RUN!

Posted January 12, 2026

By Davis Wilson

![[CES Las Vegas] 150,000 People + The Best Investments](http://images.ctfassets.net/vha3zb1lo47k/6ndLVzmV8iv1Kgpbfavg8D/082f21c83836c7e69673d6feec09fa95/shutterstock_2504318297__1_.jpg)

[CES Las Vegas] 150,000 People + The Best Investments

Posted January 10, 2026

By Davis Wilson

![[Exclusive] My Interview with a Quantum Exec.](http://images.ctfassets.net/vha3zb1lo47k/3UYc4HXc9PHtSbMsv1Wcto/ea4f48860898eaf28c3b83a04ed02b7a/mis-01-09-26-featured.jpg)

[Exclusive] My Interview with a Quantum Exec.

Posted January 09, 2026

By Davis Wilson