Posted October 31, 2025

By Davis Wilson

How About a Friendly Wager?

Back in 2017, I made a simple bet with a colleague:

Ethereum would hit $300 before it ever touched $100.

At the time, ETH was trading around $200. Most of the world still didn’t know what Ethereum was or why its price was rocketing higher.

A few weeks later, I was proven right.

Ethereum broke through $300 and kept running to $1,500 before the crypto winter began.

My prize was a Bitcoin sweater that I’m devastated to admit I’ve since misplaced.

So today, I’m making a new wager.

Nvidia (NVDA) just crossed a $5 trillion market cap, and plenty of people think that number is absurd.

Maybe you’re one of them.

Here’s the bet:

I say Nvidia hits $6 trillion before it drops to $4 trillion.

Once again, it’s sitting right in the middle, just like Ethereum was back in 2017.

And yes, this is a real bet.

The first reader to email me at AskDavis@paradigmpressgroup.com can take me up on it.

If you win, I’ll buy you an Nvidia sweater.

If I win, you owe me one.

I’ll announce the challenger in Saturday’s Q&A.

So, what do you say? Would you take that bet?

Now, to be clear, anything can happen in the short term.

A Trump tweet, Middle East flare-up, or one bad China headline could easily knock Nvidia lower.

But big picture the trend looks unstoppable.

The AI buildout isn’t slowing down. It’s accelerating.

And after this week’s Big Tech earnings my conviction is stronger than ever:

Meta (META):

“We currently expect 2025 capital expenditures... to be in the range of $70 billion to $72 billion, increased from our prior outlook of $66 billion to $72 billion. Our current expectation is that CapEx dollar growth will be notably larger in 2026 than 2025.” – Meta CFO Susan Li

Microsoft (MSFT):

“With accelerating demand and a growing RPO balance, we're increasing our spend on GPUs and CPUs... and now expect the FY '26 growth rate to be higher than FY '25.” – Microsoft CFO Amy Hood

Alphabet (GOOG):

“We’re continuing to invest aggressively... We now expect CapEx to be in the range of $91 billion to $93 billion in 2025, up from our previous estimate of $85 billion... Looking out to 2026, we expect a significant increase.” – Alphabet CFO Anat Ashkenazi

Amazon (AMZN):

“Looking ahead, we expect our full year cash CapEx to be approximately $125 billion in 2025, and we expect that amount will increase in 2026.” – Amazon CFO Brian Olsavsky

If you’re keeping score, that means three of the biggest companies on Earth are all saying the same thing: AI spending isn’t slowing down. It’s accelerating.

These firms already spend tens of billions a year on GPUs, data centers, and cloud infrastructure.

And they’re telling us that next year they’ll be spending even more.

That’s the kind of visibility investors dream of.

Because for every dollar those firms pour into AI infrastructure, Nvidia stands to collect a slice. (Estimates are approximately 50%)

So while headlines will eventually call the stock “bubblicious” or “priced for perfection,” the company’s top customers tell a different story.

That’s why I’m taking this bet: $6 trillion before $4 trillion.

Email me if you want in on the friendly wager.

Just know I’ve seen this playbook before.

And with the first real cold front hitting Texas this week… I could really use another sweater.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Do or Dye: Crucial Lesson From "Dr. Doom"

Posted October 29, 2025

By Davis Wilson

Calendar Reminder: AI Bubble (Wednesday, October 29)

Posted October 27, 2025

By Davis Wilson

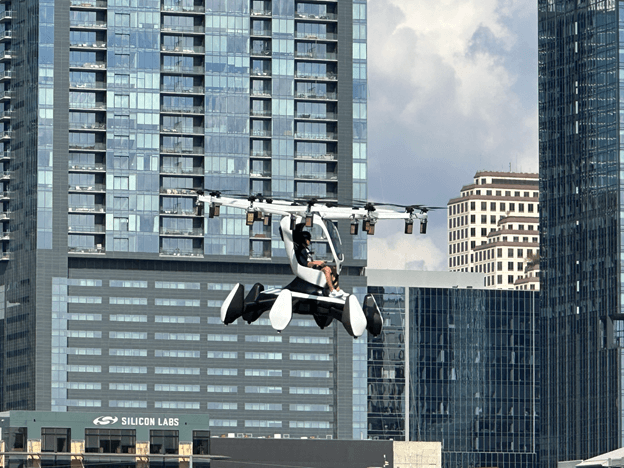

Flying Cars… Pebble Mines… and The Whiskey Bar

Posted October 25, 2025

By Davis Wilson

My Experience Test Piloting a “Flying Car”

Posted October 24, 2025

By Davis Wilson

To Short Squeezes and Beyond(Meat)!

Posted October 22, 2025

By Davis Wilson