Posted July 16, 2025

By Davis Wilson

“I’ll Wait for the Dip” – The 5 Most Expensive Words in Investing

“I missed it.”

“I’ll wait for a pullback.”

“Feels too late to buy now.”

If you’re like most investors, you’re probably telling yourself one of these right now.

That instinct (to wait for the dip) feels smart…

But history says it’s one of the most costly mistakes you can make.

Because buying when stocks are hitting new highs?

It’s not just okay. It’s often the most profitable move you can make.

The Psychological Trap of “Waiting for the Dip”

Our brains are wired to fear buying into strength.

It feels like walking into a party right before it ends.

The headlines say “overbought.” Your friends say, “it’s due for a correction.”

You tell yourself: “I’ll wait for a better entry.”

But what if the dip never comes?

That’s exactly what happened to many investors during the 1982–2000 bull market – one of the greatest runs in history.

Over that 18-year stretch, the S&P 500 returned nearly 1,400%, and the Nasdaq gained over 3,600%.

Stocks didn’t go up in a straight line, of course.

There were corrections, but the general trend was up.

Plenty of people waited on the sidelines, however. Some forever.

They were paralyzed by the fear of buying too late – and they missed the compounding.

The lesson? Markets trending up can stay up for years. And trying to time short-term dips often backfires.

Buying at All-Time Highs: What the Data Really Shows

Let’s kill the myth that buying the top is a dumb move.

A study by Ben Carlson looked at every time the S&P 500 hit an all-time high going back to 1928 – nearly 1,200 instances in total.

Then he tracked performance afterward.

Here’s what he found:

- 1 year later average return: +13.9%

- 3 years later (annualized): +10.5%

- 5 years later (annualized): +9.9%

So what does that mean?

Buying at all-time highs has historically delivered strong, consistent returns – with no meaningful drop-off in performance compared to buying at any other time.

In fact, the market tends to reward strength – not punish it.

Carlson also tested a bold idea:

What if you only bought the S&P 500 when it was making new highs – and never bought the dip?

From 1988 to 2020, that strategy delivered nearly identical long-term returns to regular dollar-cost averaging… with less volatility and no market timing stress.

Other research backs this up:

- Dimensional Fund Advisors studied 1,000+ all-time highs and concluded:

“Investing after market highs does not mean you’re doomed to poor returns. The data shows no meaningful difference in outcomes.”

- S&P Global’s Howard Silverblatt found that in secular bull markets, new highs are more likely to signal momentum – not exhaustion.

So while all-time highs may feel risky, history tells a different story: They’re often green lights, not red flags.

Why This Bull Market Might Just Be the Beginning

It’s easy to feel like you’ve missed it.

The S&P 500 is sitting at record highs…

Nvidia just smashed through a $4 trillion market cap…

And tech giants are unleashing billions in new AI spending almost every week.

But step back and this looks familiar.

In the 1990s, the internet went from fringe experiment to global necessity.

Amazon, Microsoft, and Google were all called “overvalued” before going on to become multi-trillion dollar companies.

Those who waited for better prices never got them.

This AI wave is following the same early pattern:

Enterprise adoption is just beginning.

Consumer-facing tools are hitting the mainstream.

Chip demand is booming.

Entire software stacks are being rebuilt from the ground up.

And the biggest winners haven’t even been crowned yet.

Will there be volatility? Of course. Every secular boom has it.

But when you're in the early innings of a generational tech shift, “too late” is usually just noise.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Calendar Reminder: AI Bubble (Wednesday, October 29)

Posted October 27, 2025

By Davis Wilson

Flying Cars… Pebble Mines… and The Whiskey Bar

Posted October 25, 2025

By Davis Wilson

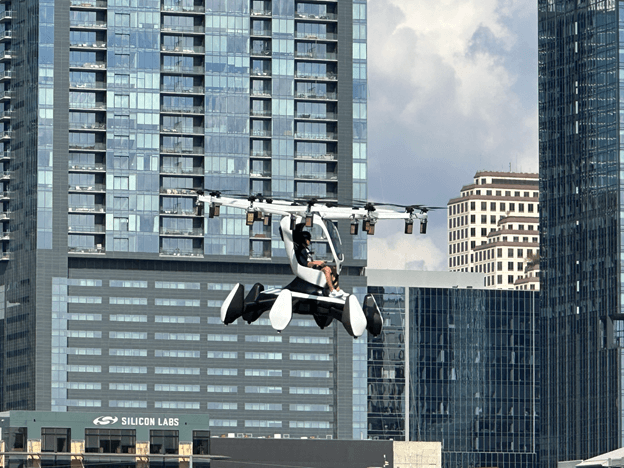

My Experience Test Piloting a “Flying Car”

Posted October 24, 2025

By Davis Wilson

To Short Squeezes and Beyond(Meat)!

Posted October 22, 2025

By Davis Wilson

Paradigm’s Top Minds Reveal Their #1 Stocks for 2026

Posted October 20, 2025

By Davis Wilson