Posted January 07, 2026

By Davis Wilson

Live from Las Vegas – Amazon’s Next BIG Move

Amazon (AMZN) is quietly building the next Starlink.

And the best part?

The market is completely missing it.

That’s the real story from CES in Las Vegas.

CES is the largest technology conference in the world, with roughly 130,000 people flooding the convention center this year.

I’m roaming showroom floors packed shoulder to shoulder with autonomous vehicles, futuristic tech, nonstop AI demos, and even robots playing tennis.

All of that is impressive.

But the most important thing I’ve seen this week isn’t on the main floor.

It’s happening behind closed doors at Amazon.

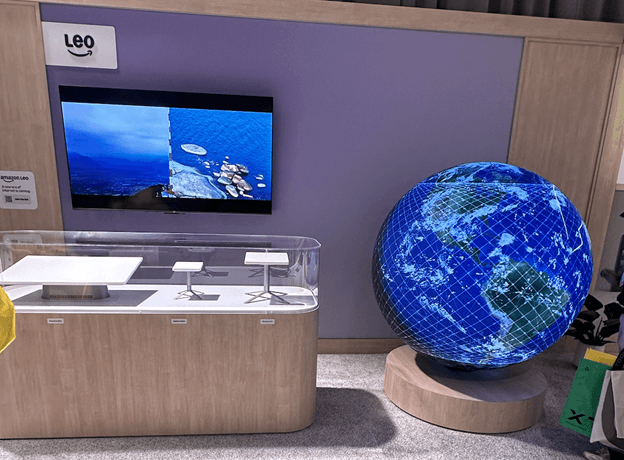

Amazon Leo: The Next Starlink

Amazon did not have a traditional booth at CES.

Instead, the company rented out its own private conference room to showcase what it is building.

Front and center were the newest versions of Kindle, updated Ring doorbells, and even an AI wearable assistant called Bee.

All impressive. All very “Amazon.”

But the most important thing in the room was not the easiest to spot.

Off to the side all alone was Leo.

Leo is Amazon’s low-Earth-orbit satellite network.

In plain terms, it’s Amazon’s answer to SpaceX’s Starlink.

Instead of relying on traditional infrastructure like cell towers or fiber-optic cables in the ground, both Leo and Starlink use these low-Earth satellites to beam internet directly to homes, businesses, ships, aircraft, and remote regions.

This approach dramatically expands where broadband can reach and turns connectivity into a global subscription service rather than a local utility.

And Amazon’s progress is a lot further along than investors realize:

- A target constellation of 3,000 satellites

- 175 satellites already in orbit

- 80 launches planned for 2026

- Each launch capable of carrying ~25–35 satellites

Put that together and it’s clear Amazon is approaching meaningful global coverage much sooner than most investors realize.

Yet Leo receives almost no attention in Amazon’s valuation.

Here’s Why This Disconnect Matters

The market already understands how valuable this type of business can be.

Just look at SpaceX.

As Satnews explains:

“Although the Falcon and Starship launch vehicles generate significant media attention, the $800 billion valuation is driven almost entirely by the Starlink business unit. The launch division functions effectively as a loss leader to deploy infrastructure, characterized by high capital expenditures and lower margins. Starlink, conversely, operates with software-like margins once the assets are in orbit. With an estimated 8.5 million subscribers generating over $10 billion annually in recurring revenue, Starlink provides the cash flow engine that justifies the aggressive valuation multiples, distinct from the transactional nature of selling aircraft or missiles.”

The takeaway is straightforward.

The rockets are the cost. Starlink is the profit engine.

Forbes reinforces this view:

“As valuation speculation grows, analysts increasingly point to Starlink as the engine behind these expectations.”

That understanding is already reflected in how investors think about SpaceX, which is now rumored to be going public in 2026 at a valuation as high as $1.5 trillion.

But when it comes to Amazon?

Leo gets no such credit.

It is not meaningfully reflected in Amazon’s valuation. It is barely discussed. Most investors don’t even know it exists!

That is the disconnect.

Amazon (AMZN): I’m a Buyer

Despite everything Amazon has going for it, the stock went nowhere in 2025.

AMZN finished the year up only mid single digits while investors chased louder, more fashionable tech stories.

To be clear, Amazon still is not cheap.

The stock trades around 34x trailing earnings and roughly 30x forward earnings.

But valuation is not just about multiples. It is about growth potential.

Amazon already dominates global e-commerce.

AWS remains one of the most important pieces of cloud infrastructure in the world.

And layered beneath both is Leo, a satellite broadband business with true rocketship potential that is barely acknowledged by the market.

That combination matters.

AMZN is not a fit for my Million Mission portfolio, as I am hunting for true outliers.

But after seeing Leo up close at CES, Amazon is exactly the kind of stock I want to own long term while the market looks the other way.

That is why I am adding Amazon to my personal long-term portfolio, and why I will look to trade the stock opportunistically in the Million Mission portfolio during periods of broad market weakness.

Stick with The Million Mission as I keep bringing you CES updates straight to your inbox.

Much more to come.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

My Perfect Portfolio - Major Changes

Posted January 14, 2026

By Davis Wilson

Trump + Bernie Sanders = RUN!

Posted January 12, 2026

By Davis Wilson

![[CES Las Vegas] 150,000 People + The Best Investments](http://images.ctfassets.net/vha3zb1lo47k/6ndLVzmV8iv1Kgpbfavg8D/082f21c83836c7e69673d6feec09fa95/shutterstock_2504318297__1_.jpg)

[CES Las Vegas] 150,000 People + The Best Investments

Posted January 10, 2026

By Davis Wilson

The REAL Venezuela Trade w/ Tickers

Posted January 05, 2026

By Davis Wilson

“Am I Crazy?”

Posted January 03, 2026

By Davis Wilson