Posted June 11, 2025

By Davis Wilson

Mag-6, Sorry Apple

This isn’t Steve Jobs’ Apple.

Today’s Apple has no innovation… boring reveals… and no clear roadmap.

Case and point: this week's Worldwide Developers Conference (WWDC.)

If you missed it, don’t worry – so did the market.

The stock closed the day down 1.2%, a rare shrug for an event that usually drives buzz and optimism.

There was no groundbreaking new product, no big announcement.

Instead, the highlight was something called “Liquid Glass,” a new screen design that looks eerily similar to Windows Vista circa 2007.

From an investment perspective, this was a non-event.

Cosmetic updates aren’t what moves markets – especially not for a $3 trillion company.

What investors were really looking for was an update on Apple’s artificial intelligence ambitions.

And on that front, Apple said… nothing.

Still Waiting on “Apple Intelligence”

To be fair, Apple has already teased its response to ChatGPT.

Last year, it announced Apple Intelligence, complete with a demo showing a “more personal” Siri that could intelligently parse your messages and emails to suggest a good time for a dinner reservation. (And much more, of course.)

But in March, the company delayed the feature, quietly pulled some of the ads promoting it, and has remained vague about when it might launch.

Monday’s WWDC did little to clear that up.

Apple’s software chief Craig Federighi simply said the work “needed more time to meet our high quality bar” and reaffirmed a vague “coming year” timeline.

That’s not the kind of clarity investors were hoping for.

AI is the story right now.

Nvidia’s market cap has more than doubled over the last year thanks to its dominance in the space.

Microsoft, Meta, and Google are all embedding AI across their products and platforms at breakneck speed.

Even Amazon, which was slow to start, is now racing to catch up.

Apple? Still talking about design language…

Apple's Innovation Problem

It’s not just that Apple isn’t leading the AI race – it’s that it’s barely in the race at all.

The company’s core strength has always been hardware, and it’s still world-class in that department.

But investors want to see future growth drivers, not incremental improvements to screens or camera lenses.

I could argue that the last true needle-mover from Apple was the iPhone. That was 2007.

Since then, we’ve seen product extensions (AirPods, Watch), but nothing that reshaped the market in the way products from Tesla, Nvidia, or even Meta have.

In fact, I’d go far enough to say that Apple has become the least innovative of the so-called Magnificent 7 stocks.

Here’s Where I Stand as an Investor

Despite the lack of innovation, Apple still trades like a high-growth tech company.

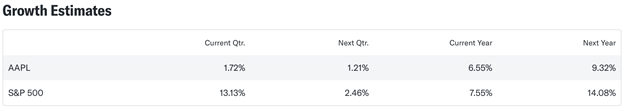

Apple’s stock currently commands 31x earnings – a premium valuation for a business that’s growing slower than the S&P 500.

Here’s a screenshot straight from Yahoo! Finance:

Sure services revenue is up, but iPhone and hardware growth are sluggish.

China and tariffs remain a weak spot. And now the AI narrative is being dominated by its peers.

At some point, the stock’s multiple has to reflect reality.

Maybe that’s why Warren Buffett is trimming his Apple position.

Berkshire Hathaway sold over 600 million shares of AAPL over the last year – an uncharacteristically aggressive move from a famously patient investor.

So where do I stand?

If I had to rank the Mag 7 on investability right now, Apple would be at the bottom.

Yes, below Tesla.

At least Tesla has potential outlier technologies in the pipeline, like humanoid robots and robotaxis.

You may not believe those will work, but if they do, they can drive exponential growth.

[Note: Tesla just started testing Robotaxis on the streets here in Austin this week.]

With Apple, what’s the bull case? A prettier screen? Maybe a useful version of Siri in a few years?

Until I see meaningful movement on AI, or some bold vision for the next decade, Apple’s going in the “pass” column for me.

Instead, I’ll keep my portfolio focused on companies building the future, not just polishing the past.

P.S. Not everyone in our Paradigm stable is disappointed with this week's announcements…

I know James Altucher is still expecting something big from Apple before WWDC comes to a close.

And the best news… It doesn’t involve buying AAPL stock.

More on this later this week.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

NEW Senate Bill: Crypto Clarity... FINALLY!

Posted June 25, 2025

By Davis Wilson

"Stablecoins" 3...2...1...Liftoff

Posted June 23, 2025

By Davis Wilson

A 68-Year-Old Investor. A $25K Dilemma. A Real Answer.

Posted June 21, 2025

By Davis Wilson

Stablecions Saved My Friend $120,000

Posted June 20, 2025

By Davis Wilson

The Mainstream Media Won’t Tell You This

Posted June 18, 2025

By Davis Wilson