Posted January 30, 2026

By Davis Wilson

META⬆️MSFT⬇️TSLA⬇️

This was one of the biggest weeks in recent stock market history!

Most investors don’t even realize it.

They’re too busy debating bubbles and politics.

Meanwhile, some of the largest and most influential companies in the world just reported earnings.

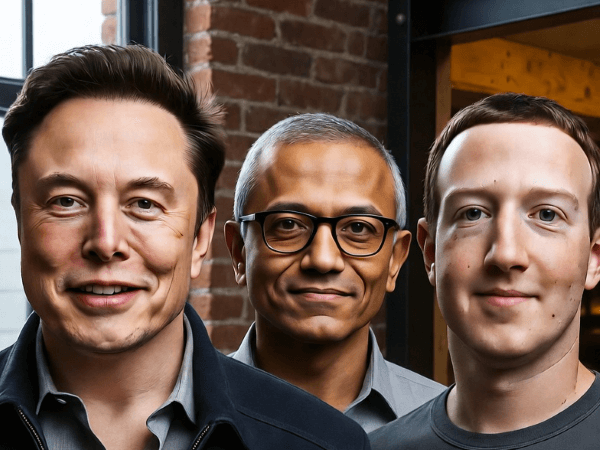

Just this week we heard from Zuckerberg, Elon, Satya Nadella and others shaping the future.

Some stocks exploded higher. Others got crushed.

Here’s what happened – and why it matters.

META Goes BOOM!

Meta delivered one of the strongest earnings reports of the season and the market loved it.

Earnings snapshot:

- Earnings per share: $8.88 vs. $8.23 expected

- Revenue: $59.9 billion vs. $58.6 billion expected

The real upside came from guidance. Meta expects first-quarter revenue between $53.5 billion and $56.5 billion, well ahead of Wall Street estimates.

That matters because AI spending has been under intense scrutiny.

Investors wanted proof that massive AI investments were translating into real financial returns.

Meta provided it.

Revenue grew 24% year over year, driven primarily by advertising, and management said it plans to spend $115–$135 billion on AI this year.

That’s nearly double last year’s spend. And this time the market rewarded it.

Shares jumped roughly 11%.

So much for the AI bubble.

Microsoft Gets Hammered

Microsoft also beat earnings and revenue expectations, yet the stock sold off sharply.

Earnings snapshot:

- Earnings per share: $4.14 adjusted vs. $3.97 expected

- Revenue: $81.3 billion vs. $80.3 billion expected

The problem wasn’t demand. It was supply constraints.

CFO Amy Hood admitted on the earnings call that Azure would have grown faster if Microsoft had been able to direct all newly acquired GPUs into the cloud business during Q1 and Q2.

That’s a stunning confession.

Enterprise AI demand is exploding. Customers are ready to spend.

But Microsoft simply can’t source compute capacity fast enough.

This capacity crunch isn't just a Microsoft problem.

It's an industry-wide bottleneck as cloud providers race to secure Nvidia GPUs and build out data center infrastructure.

This supply constraint is happening at the same time Microsoft’s capital expenditures and finance leases jumped 66% to $37.5 billion in the quarter.

When you’re spending aggressively and still showing slower-than-expected growth in the segment meant to justify that spending, investors start questioning execution.

That’s what the stock reacted to.

Microsoft finished yesterday down 10%.

Elon: “Look Over There!”

Tesla posted better-than-expected quarterly results, but the longer-term trend remains under pressure.

Earnings snapshot:

- Earnings per share: $0.50 adjusted vs. $0.45 expected

- Revenue: $24.9 billion vs. $24.8 billion expected

Full-year revenue declined 3%, falling to $94.8 billion from $97.7 billion the prior year. Tesla cited lower vehicle deliveries and reduced regulatory credit revenue.

With the core auto business facing increasing competition, Elon Musk again shifted investor attention toward AI.

Tesla announced a $2 billion investment in xAI, along with a broader partnership designed to help deploy AI into real-world physical systems at scale.

It’s not a Tesla–SpaceX merger that I've previously hypothesized. But it clearly moves two of Musk’s prized assets closer to each other.

As for Tesla, I’m still not touching the stock.

16x sales, 300x earnings, falling revenue?

Not for me.

Software Stocks (Still) in Freefall

Software names continued to sell off, led by ServiceNow.

ServiceNow earnings snapshot:

- Earnings per share: $0.92 adjusted vs. $0.88 expected

- Revenue: $3.57 billion vs. $3.53 billion expected

Despite beating expectations, raising 2026 guidance, maintaining a 98% customer renewal rate, and approving an additional $5 billion in share buybacks, the stock fell 10%.

Salesforce and Adobe declined in sympathy.

These stocks are now down 40–50% from their highs.

The market narrative is that AI will erode the moats of legacy software companies.

That narrative still doesn’t make much sense.

Replacing deeply embedded enterprise platforms is slow, complex, and risky.

AI tools don’t simply rip out Salesforce, Adobe, or ServiceNow from Fortune 500 workflows overnight.

At some point, fundamentals matter again.

I’m getting close to smashing the buy button here.

Stay tuned.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The Next Warren Buffett (According to Big Short Star)

Posted January 28, 2026

By Davis Wilson

Your Fav Stocks Could Move 15% This Week

Posted January 26, 2026

By Davis Wilson

Moonshots: Ticker: ELON… NAK… FNMA

Posted January 24, 2026

By Davis Wilson

Ticker Symbol: ELON… Coming Soon

Posted January 23, 2026

By Davis Wilson

T.A.S.M. (Trump Always Scares Markets)

Posted January 21, 2026

By Davis Wilson