Posted January 24, 2026

By Davis Wilson

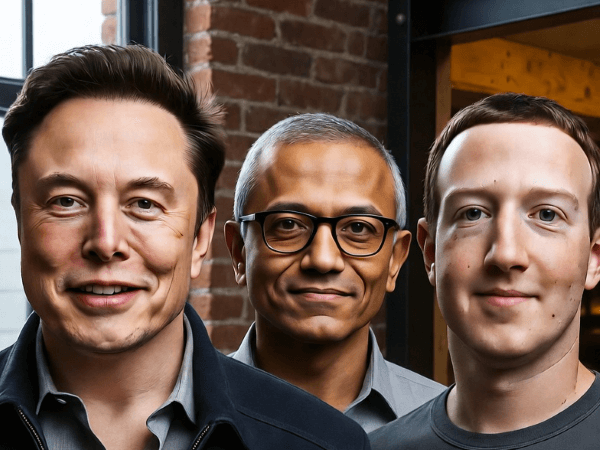

Moonshots: Ticker: ELON… NAK… FNMA

I hope you’re staying warm out there!

Between the cold weather rolling in and the markets staying as unpredictable as ever, it’s been one of those weeks where everyone’s looking for a little clarity.

And as always, the questions didn’t disappoint.

This week’s Q&A covers everything from my favorite long-term names right now to my highest-upside “asymmetric” bets… plus a few surprises I wasn’t expecting to write about this week.

Let’s jump in.

It was like looking in the mirror reading the 68-year-old “ant” in last week’s Q&A. My wife and I have made a comfortable retirement. Annuity payments and Social Security. But not enough for a legacy or enjoyment. Currently, I have $100k in the market. Most of it in dividend stocks. I just started moving into tech and rare earths. So what sector do you feel will gain the most from this market “geopolitical” scare? Long term or high risk stocks? – RC

RC, thanks for the great question. By definition, high-risk stocks should outperform over time. Right? You should be compensated with a higher return for taking on higher risk.

That said, risk doesn’t mean guaranteed profits. Between now and when these themes really play out, there will be plenty of ups and downs, and the market will overreact in both directions.

But since I talk about a ton of tickers here in The Million Mission, here are a few that I like right now:

Stocks I like for the long-term:

Amazon (AMZN), Rocket Lab (RKLB), Nvidia (NVDA), Uber (UBER), and my “Nuclear Trifecta” of Amentum (AMTM), Solstice (SOLS), and Centrus Energy (LEU).

Higher-risk names I like (more volatile, higher upside potential):

You guessed it… Fannie Mae (FNMA) and Northern Dynasty (NAK).

I understand that strategically Greenland would be a good investment, but the way Trump is going about this is just pissing off our allies. Couldn’t we offer to make them a protectorate of the U.S. and achieve the same results? Also, if it's rare earth minerals we are looking for, wouldn't the Pebble Creek mine (Northern Dynasty) in Alaska be a faster and easier solution? – John

Thanks for the question, John! I want to be clear that I don’t think this is a rare earth move.

Trump has even said himself that rare earth minerals aren’t actually rare. It’s the production process that’s rare. So this really seems to be about defense.

That said, I think the best explanation I’ve seen for Trump’s behavior came from a tweet I unfortunately can’t find. It went something like this:

“Greenland is a win-win for Trump. If Europe rolls over, the U.S. gains territory, a major strategic military position, and whatever resources are sitting under the surface. If Europe pushes back and shows some backbone, that’s a win too. America needs allies with strength, not complacency. Europe’s been drifting politically and economically for years. Maybe this wakes them up.”

This is the best answer I’ve heard. But do you ever really know with President Trump?

I love your articles. Yours are ones I never miss and enjoy reading every day. With everything going on with Netflix, is this a SMASH the buy button or wait and see what comes out of the potential merger? Thanks for reading and continue the great work. – David

Great question, David. I’ve been looking into Netflix (NFLX) a lot during the recent move lower.

I’m not SMASHING the buy button yet. But I’m close.

Look out for a full write-up next week.

I enjoy your column. Always gets me thinking, which inevitably leads to questions. :-) Is NAK simply a one-horse, one-in-a-million shot or is there something more to this position? I can think of a scenario or two where the stock could increase in value without any development, much less production. Is this what you are gambling on? And, if so, what event do you think would cause such a gain? – Lee

Thanks for the question, Lee. I wouldn’t call NAK a “one-horse, one-in-a-million” shot.

It’s more of a messy “he said, she said” situation, and that’s exactly what makes it interesting.

The biggest example is what happened with the Pebble Project’s Final Environmental Impact Statement (EIS). In July 2020, the Final EIS found the proposed mine could coexist with healthy fish and wildlife populations in southwest Alaska, would have no impact on commercial, subsistence, or sport fisheries in Bristol Bay, and could provide a meaningful socioeconomic boost to Alaska.

But despite those findings, the U.S. Army Corps of Engineers later issued a Record of Decision (ROD) in November 2020 that reached the opposite conclusion.

That contradiction is hard to ignore.

And to your point, there are plenty of scenarios where NAK could move higher even without the mine being developed anytime soon. Deregulation, higher metals prices and demand, or the U.S. government taking a more active role in domestic mining are all possible catalysts.

In fact, the stock has already been responding to incremental news. It’s up about 100% since I bought it.

Feel free to read more here. For now, I’m holding and watching closely for the next major development.

I have positions in NAK, UBER, and FNMA per your Million Mission project. I was just wondering if you could address the situation of FNMA taking a nosedive last week and give us your thoughts on the matter. – Roe

Hi, Roe. Fannie Mae (FNMA) is up to $9 now, a bit above my $7.25 entry price.

The stock was up to $15 in September, though.

Federal Housing Finance Agency Director Bill Pulte has said Trump would decide on the next steps for the IPOs of Fannie and Freddie in the next month or two. That’s the catalyst I’m waiting for.

Odds look good that Fannie and Freddie will be released from conservatorship eventually. Will this be the time? Stay tuned.

So should we just buy Tesla stocks and wait for ticker change over to ELON? – Steve

Steve, great question regarding my Friday note: Ticker Symbol: ELON… Coming Soon.

But no, I’m not buying Tesla right now just hoping it eventually turns into an “ELON” mega-ticker.

Although there’s a clear argument for Elon consolidating his companies into one, I’m still not a fan of the valuations Elon’s companies tend to get.

The market often prices in a perfect future far ahead of reality, and that leaves less room for error.

For now, I think there are simply better opportunities elsewhere in the market where the risk/reward is clearer and the valuations are more attractive – like the stocks I mention in the first question.

What’s your portfolio look like today? – Gary

Scroll down!

Important Update: Follow The Million Mission on Twitter/X

Big news: I just launched a Twitter/X account so you can follow along with The Million Mission in real time. If you want quicker insights, early reactions to breaking news, and a closer look at how I’m navigating the road to $1 million – this is where I’ll be.

Come hang out, ask questions, and follow the Mission as it happens @DavisPWilson.

Another Important Update: The Million Mission website is live!

I’ve gotten plenty of feedback regarding where to find previous alerts. Well, The Million Mission website is finally live and you can check out archived alerts here.

Portfolio Overview

Here’s what I’m currently holding in The Million Mission portfolio:

Fannie Mae (FNMA) – 2,500 shares @ $7.25/share.

Northern Dynasty (NAK) – 5,000 shares @ $1.11/share

Nvidia (NVDA) call options – $200 strike price expiring February 20, 2026

Uber Technologies (UBER) – 140 shares @ $82/share

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The Wilson Family's WORST Investment Mistake

Posted February 02, 2026

By Davis Wilson

META⬆️MSFT⬇️TSLA⬇️

Posted January 30, 2026

By Davis Wilson

The Next Warren Buffett (According to Big Short Star)

Posted January 28, 2026

By Davis Wilson

Ticker Symbol: ELON… Coming Soon

Posted January 23, 2026

By Davis Wilson

T.A.S.M. (Trump Always Scares Markets)

Posted January 21, 2026

By Davis Wilson