Posted August 22, 2025

By Davis Wilson

My Dinner With a Tesla Insider

Most people think they know Tesla.

For years, the story has revolved around the same themes: electric cars, battery range, autonomy, and of course, Elon Musk.

But over dinner last night, I spoke with someone who sees Tesla from a very different perspective: a senior engineer working on the company’s batteries.

This wasn’t a carefully scripted investor day or a viral tweet.

It was an off-the-record conversation with someone building the technology that keeps Tesla moving forward.

And what he told me gave me three insights about Tesla’s future that most investors don’t fully appreciate.

None of them are obvious.

All of them are fascinating.

And together, they challenge the narrative Wall Street keeps recycling about this company.

Insight #1: Battery Range Doesn’t Matter in a Driverless Future

For years, electric vehicle makers have been locked in an arms race over who can deliver the longest range.

Tesla has proudly advertised cars capable of 300–400 miles on a single charge.

Rivals like Lucid and Mercedes have pushed even further, hoping range alone will lure buyers.

So when I sat down with a senior Tesla battery engineer, I expected our conversation to center on squeezing out more miles from each cell.

Instead, he told me that line of thinking is already outdated – at least if you believe autonomous vehicles are inevitable.

In a driverless future, consumers aren’t tied to the car in their driveway.

They’re hailing rides from an autonomous fleet.

If one vehicle runs low on charge, it simply drives itself to the nearest charger, recharges, and returns to service.

For the rider, range anxiety disappears.

For Tesla, the true battleground becomes charging logistics, fleet efficiency, and software.

That shift may sound subtle, but it completely flips the way investors should evaluate Tesla and the automotive market altogether.

Forget selling cars.

If autonomy takes hold, the winning hand won’t be a battery that goes 50 miles farther. It will be the ecosystem that keeps fleets moving with minimal downtime.

And then came the part I least expected.

When I asked what Tesla’s top strategic focus was right now, he didn’t say battery chemistry.

He said supply chain.

Inside Tesla, the number-one priority is reorganizing the supply chain to reduce dependence on China.

With Washington and Beijing at odds, and the future of global trade uncertain, Tesla is racing to de-risk its most vulnerable chokepoint.

Wall Street rarely talks about it, but it could be one of Tesla’s most important storylines.

Insight #2: Elon Musk Is a Bottleneck

The second takeaway was about leadership.

“Elon is the single node in a lot of decisions that slows Tesla’s progress,” my dinner guest told me.

That line stuck with me.

On one hand, Musk’s vision has made Tesla what it is.

Without his relentless drive, the company might not exist, let alone dominate the EV industry.

But there’s a flip side.

When one person insists on weighing in on everything – big and small – you create a bottleneck.

And bottlenecks don’t mix well in the hypercompetitive technology industry.

Tesla is no longer a scrappy startup.

It’s competing on multiple fronts (EVs, batteries, energy storage, robotics, and AI) while fighting off competitors that are better capitalized than ever.

The stakes are higher now.

A company this complex can’t afford to move at the pace of one person’s decision-making – especially when that person simultaneously leads 5 other companies.

Investors often describe Tesla as agile and fast.

But the insider painted a more complicated picture.

Sometimes projects stall waiting for Elon to sign off.

That tension is one of Tesla’s biggest hidden risks.

Insight #3: Even Insiders Think the Stock Is Overvalued

The third revelation was the most surprising.

This engineer (whose career depends on Tesla’s success) told me flat out that he believes the stock is overvalued.

That’s not a short-seller looking for TV time.

It’s not a hedge fund manager with a bearish thesis.

It’s someone on the inside, building the very technology Tesla relies on.

And even he thinks the market has bid the stock too high.

Tesla’s valuation has always been polarizing.

At Tesla’s current $1T valuation, the company is worth more than Ford, GM, Toyota, Volkswagon, Stellantis, Mercedes, Lucid, and Honda COMBINED… despite selling a fraction of the vehicles.

Bulls argue it deserves the premium because Tesla is really an AI, energy, and robotics company rolled into one.

Bears argue the fundamentals can’t support it.

Hearing an insider lean toward the bearish view gives that argument more weight.

When the people building the product think the market has gotten carried away, it’s worth paying attention.

Here’s What This Means For You

These insights aren’t the sort of things you’ll hear in a quarterly earnings call.

They’re the candid perspectives you only get when talking to the people who actually build the product.

And for investors, they raise important questions.

- If autonomy reshapes the industry, are we focused on the wrong metrics?

- Is Elon still the man for the job at Tesla?

- And if insiders think the stock is overvalued, what does that say about the risk/reward at today’s levels?

Tesla is not a normal company.

Its future could still hold extraordinary breakthroughs.

But as my dinner conversation reminded me, investors shouldn’t just listen to headlines or polished presentations.

Sometimes the sharpest perspective comes not from the CEO on stage… but from the engineer across the dinner table.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

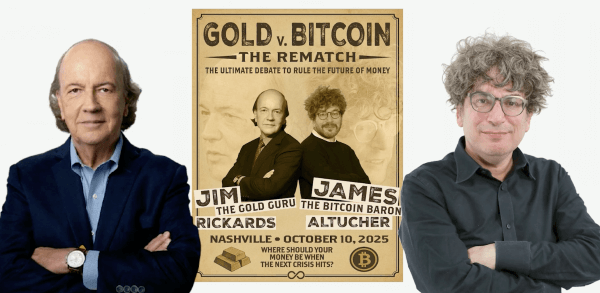

Altucher vs Rickards: The Rematch 7 Years In the Making

Posted October 13, 2025

By Davis Wilson

A Special Q&A from Nashville (plus my latest buy)

Posted October 11, 2025

By Davis Wilson

Reporting Live from Nashville!

Posted October 10, 2025

By Davis Wilson

The EPA, Trump, and +40% on NAK

Posted October 08, 2025

By Davis Wilson

AMD’s 30% Surge – Strange But True

Posted October 06, 2025

By Davis Wilson