Posted July 07, 2025

By Davis Wilson

Simple (And 100% Free) Stock Picking 101 in <10 Minutes

Want to be a better investor?

Today’s alert will help, regardless of your skill level.

I’m showing you how to pick stocks using only the free version of Yahoo! Finance.

I’ll use Nvidia as my example, but you can use this method with any stock.

Step #1: Type in the company name or ticker into the “Quote Lookup” search bar on the right side of the Yahoo! Finance homepage.

The “Summary” tab will appear.

Here’s a screenshot of NVDA’s “Summary” tab at the time I’m writing this:

On this page I’m looking at three things:

- The stock chart over various time horizons. I prefer high-quality stocks that consistently move up and to the right.

- The Market Cap. This tells you the size of the company. As you can see, Nvidia is a $3.886 trillion company.

- The last thing I’m looking at is the P/E ratio. You can think of this like cost-per-ounce labels on packaged goods at grocery stores. The higher the ratio, the more expensive the stock.

Step #2: Click on the “Financials” tab on the left side of the page.

The income statement will populate first.

I’m looking for consistent revenue and earnings growth here.

As you can see below, Nvidia has grown revenue consistently from just $26.9 billion in 2022 to $148.5 billion in the trailing twelve months (TTM).

Earnings have also grown from $9.7 billion in 2022 to $76.7 billion in the trailing twelve months (TTM).

This is insane growth. Hence why the stock has been a rocket ship over the last few years.

Step #3: Click on the “Analysis” tab on the left side of the page.

This tab provides a simplified view of expert predictions and expectations about the company's future performance.

Here’s a few screenshots of NVDA’s “Analysis” tab at the time I’m writing this:

This Earnings Estimate section shows expert estimates of earnings over various time periods.

I prefer the “Avg. Estimate” line, which is $5.76 per share next year compared to just $4.29 this year – forecasting Nvidia’s historic growth will continue.

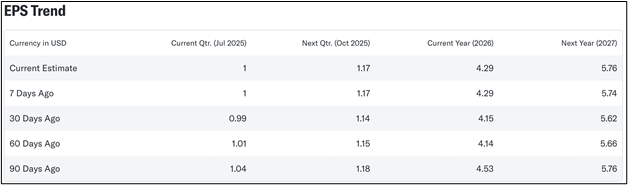

This EPS Trend section reveals how analysts’ expectations for the stock have evolved.

Over the past 90 days, Nvidia’s average earnings estimates for both 2026 and 2027 dipped briefly during the tariff scare – but have since bounced back, with next year’s forecast already fully recovering.

That’s exactly what you want to see in a high-quality name – upward-trending earnings projections that show resilience when the broader market hits turbulence.

Step #4: Combine the information to make a logical assessment.

Nvidia’s current price is $159 and the stock trades at a 51x P/E ratio.

If the stock price doesn’t move and the company achieves the average earnings estimates for next year – which is $5.76 according to the “Analysis” tab – the stock will trade at a 28x P/E ratio in one year.

[$159 divided by $5.76 equals a 28x “forward” P/E ratio.]

It’s important to note that NVDA never trades at 28x earnings, however.

Buyers consistently step in whenever the most powerful, profitable, and important AI company falls below a 50x P/E ratio – let alone 28x.

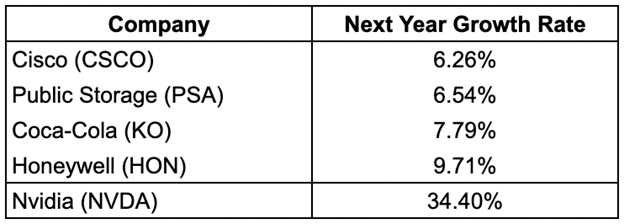

To put how cheap a 28x P/E ratio is into perspective, here’s a list of a few companies currently trading at 28x and their growth rates:

In short, these companies aren’t even in the same league as Nvidia.

That’s why I expect NVDA’s stock price to continue rising in the near future.

Based on its projected growth and current forward valuation, Nvidia is still surprisingly undervalued.

Best of all, you can use this same framework to evaluate other stocks too.

Every step I took here was done using the free version of Yahoo! Finance – no fancy tools or deep financial expertise required.

Send me an email with any questions at AskDavis@paradigmpressgroup.com, and stay tuned to The Million Mission as I look to trade NVDA to $1 million.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

FNMA@$10.50 — Genius Move? or Rookie Mistake...

Posted July 05, 2025

By Davis Wilson

Smash/Trash/Stash: SMASH This $700B “Toll Booth” – TRASH Bitcoin Kiosks

Posted July 04, 2025

By Davis Wilson

SpaceX & OpenAI – A Brand New Way to “Buy”

Posted July 02, 2025

By Davis Wilson

Today’s Stock Market (June 30) Is a TRAP

Posted June 30, 2025

By Davis Wilson

$2,000 Down, $898,000 To Go

Posted June 28, 2025

By Davis Wilson