Posted January 16, 2026

By Davis Wilson

“sucking wind”

Last year, I called Alphabet “the cheapest stock in the market.”

Since then, the stock is up roughly 100%.

That doesn’t mean I’ll be right every time. But it does prove something important:

When the market decides it hates a great business, valuations can get ridiculous.

And right now, I think we’re watching that happen again.

This time, it’s not just one stock.

It’s an entire industry.

Software is the cheapest industry in the market.

Or as one Wall Street analyst put it: “Software is sucking wind.”

Software’s Valuation Reset Has Been Brutal

Let’s start with a few charts that are hard to ignore.

Salesforce (CRM):

The stock is down 27% in the last year.

Salesforce now trades around 31x earnings and roughly 18x next year’s earnings.

Adobe (ADBE):

Also down 27% over the last year.

Adobe now trades at 18x earnings and just 11.5x next year’s earnings.

These are not “premium software multiples.”

These are the kinds of valuations you normally see when a business is either:

- In a deep cyclical slowdown

Or…

- Permanently losing relevance

And the selling hasn’t just hit those two names.

ServiceNow (NOW). Workday (WDAY). HubSpot (HUBS).

These stocks have all fallen off a cliff.

Yet the fundamentals have not collapsed the way the prices suggest.

This mismatch is exactly why I’m writing to you today.

Because software stocks historically traded at premium valuations for a reason.

And most of those reasons still exist today.

Here's Why Software Has Always Traded at Premium Multiples

For the last decade, software has been the market’s favorite business model. And it wasn’t hype.

Software companies earned premium valuations because they offered something rare in investing:

High margins: Once software is built, distributing it is cheap.

That creates powerful operating leverage and high profitability.

Scalability: A software business can go from 1,000 customers to 100,000 customers without needing 100,000 employees.

The product scales. Revenue scales. Costs don’t scale nearly as fast.

Sticky revenue and switching costs: This is the moat.

Corporations don’t casually rip out Salesforce, Adobe, Workday, or ServiceNow.

These tools sit at the center of workflows, sales processes, marketing operations, HR systems, and enterprise data.

They’re not “apps.” They’re infrastructure.

Replacing them means retraining teams, rebuilding integrations, risking downtime, and potentially breaking the business in the process.

That’s why enterprise software has historically been one of the most durable revenue models in the world.

And it’s why investors used to pay massive multiples for it.

Here’s the Twist: Those Strengths Still Exist

This is what makes the current setup so strange.

The market is acting like software’s advantages have disappeared.

But when you look closely, they haven’t.

Margins are still strong.

Salesforce’s operating margin increased over the last year from roughly 20% to around 22%.

That’s not a company falling apart. That’s a company getting more efficient.

Adobe’s operating margin held steady at 36%.

That’s elite. That’s exactly the kind of profitability that made software so beloved in the first place.

Software still scales.

Earnings expectations for all of the companies I’ve mentioned above have actually increased over the last 90 days while the stock prices have fallen off a cliff.

And it’s not just earnings. These companies are still signing long-term deals.

Their remaining performance obligations (RPO) have increased over the last year as well, which is a clear signal that customers are committing to future spend.

The moats are still intact.

Switching costs are still enormous.

Enterprise customers still don’t want to rip out tools that are embedded into daily workflows across thousands of employees.

And that brings us to the real culprit behind this entire collapse in sentiment.

AI Is the Real Reason Software Is Getting Punished

AI has created a new narrative in the market:

“What if software becomes commoditized?”

“What if anyone can build anything?”

“What if every CRM becomes obsolete?”

It’s an exciting story. It’s also extremely premature.

Yes, AI is improving rapidly.

Yes, it will change how software is built and delivered.

And yes, it will create new competitors.

But here’s what investors are missing:

Saying “AI can build a CRM” is easy.

Replacing Salesforce inside a Fortune 500 company is not.

Saying “AI can do everything Adobe does” is easy.

Replacing Adobe across millions of professional workflows is not.

AI is not at the point where a company can simply press a button and rebuild the entire Adobe suite, train every employee, migrate every file format, and replicate decades of tooling and muscle memory.

Even if it becomes possible someday, it won’t happen overnight.

Corporations move slowly. They avoid risk. They stick with what works.

They pay Salesforce and Adobe thousands of dollars per year not because they’re unaware of alternatives, but because the cost of disruption is massive.

Ask anyone who actually uses these platforms what they think.

They’ll complain.

They’ll gripe.

They’ll say the interface could be better. The pricing is too high. They wish the product was simpler.

But they’re not canceling their subscription.

And that’s my point.

I’m not saying these are perfect businesses that do no wrong.

I’m saying these businesses aren’t crumbling like the stock market might lead you to believe.

So… How Cheap Can Software Stocks Get?

That’s the question.

Because at some point, the market has to pick a lane.

Either:

- Fundamentals roll over and earnings start collapsing

Or…

- Valuations snap back toward reality

Right now, software stocks are being priced like broken companies.

But the data doesn’t support that narrative.

Margins are holding.

Moats are holding.

Earnings revisions are still moving higher.

Yet the stocks are “sucking wind” at bargain valuations.

When great companies are hated, there are only two ways it ends:

They break.

Or they become generational buying opportunities.

And right now, software looks a lot closer to the second scenario than the first.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The Wilson Family's WORST Investment Mistake

Posted February 02, 2026

By Davis Wilson

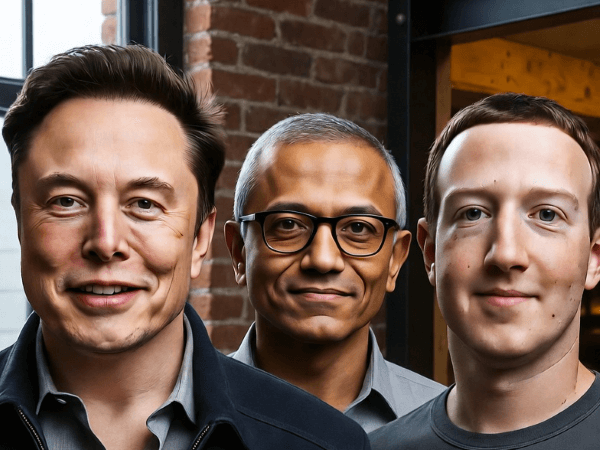

META⬆️MSFT⬇️TSLA⬇️

Posted January 30, 2026

By Davis Wilson

The Next Warren Buffett (According to Big Short Star)

Posted January 28, 2026

By Davis Wilson

Your Fav Stocks Could Move 15% This Week

Posted January 26, 2026

By Davis Wilson

Moonshots: Ticker: ELON… NAK… FNMA

Posted January 24, 2026

By Davis Wilson