Posted January 21, 2026

By Davis Wilson

T.A.S.M. (Trump Always Scares Markets)

Wait…

We’ve seen this playbook before.

Trump makes a bold claim → the stock market sinks → and within days to weeks… we rebound to new highs.

The latest “bold claim” happened yesterday.

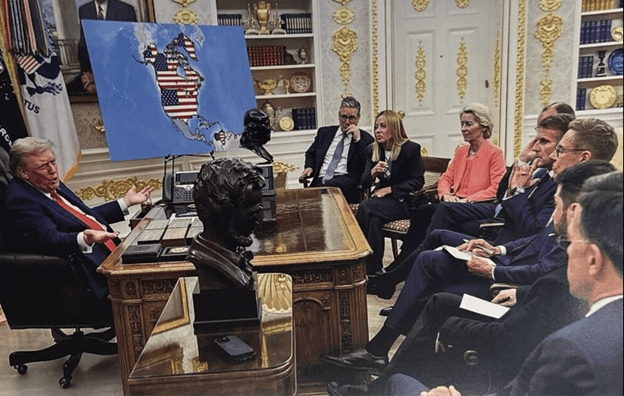

At 1:00 a.m. ET on Tuesday, Trump posted this image on Truth Social:

He also posted another image showing Greenland, Canada, and Venezuela shaded with a U.S. flag:

Markets didn’t love it.

Stocks sank Tuesday as investors priced in volatility.

- S&P 500: Down 143 points (-2.06%)

- Nasdaq: Down 561 points (-2.39%)

- Dow: Down 871 points (-1.76%)

Honestly, I don’t know how this keeps happening.

But it does.

And as investors we can take advantage of this pattern.

The Trump Shock Playbook

It looks like this:

Headline shock → risk-off selling → panic takes over → dip buyers step in → we recover → new highs.

We’ve seen it repeatedly.

Example #1: The “Mother of All Bombs” (MOAB) – April 2017

On April 13, 2017, the U.S. dropped the MOAB in Afghanistan on an ISIS tunnel complex.

Markets dipped on the initial shock, then stabilized quickly once it became clear the event wasn’t spiraling into a broader conflict.

Example #2: “Fire and Fury” – August 2017

When Trump warned North Korea of “fire and fury,” markets immediately got jittery.

The S&P 500 fell, and the VIX spiked 44%.

And then?

The market moved on.

New highs were reached in early September.

Example #3: The China Trade War Tweet – August 2019

On August 23, 2019, Trump posted that American companies were “hereby ordered” to look for alternatives to China.

The Dow dropped 623 points (2.4%), the S&P 500 fell 2.6%, and the Nasdaq dropped 3%.

Fear hit first.

Then rationality returned.

New highs were reached in October.

Now fast forward to this term.

This isn’t just ancient market history. It’s happening in real time.

Example #4: Remarks on Taiwan and Chip Protection – July 2024

In a July 2024 interview, Trump reignited Taiwan tensions by suggesting it should pay more for U.S. defense.

Chip stocks sold off, TSMC slid 17%, and the Nasdaq pulled back over 10% as investors priced in geopolitical risk.

The market eventually stabilized once it became clear there was no immediate policy action.

The market staged a “V-shaped” recovery – hitting new highs in September.

Example #5: “Liberation Day” Tariff Shock – April 2025

Trump announced sweeping tariffs in early April 2025, and markets reacted violently.

The S&P 500 fell 4.8%, with the Dow dropping nearly 1,700 points, and the Nasdaq falling nearly 6%.

It was one of those “this could be the start of something bigger” moments.

And then we got the pause.

And the bounce.

And the recovery.

Same playbook.

So… Is This Time Different?

This is the question every investor is asking.

To date, the answer has always been no.

Not because the headlines aren’t serious.

Not because volatility can’t get worse.

But because at the end of the day, the market runs on a few unavoidable truths.

First, earnings are what matters.

- Annexing Greenland isn’t going to slow the AI buildout.

- People aren’t going to buy fewer iPhones because the U.S. picked up a “51st state.”

- And consumers aren’t going to cancel Prime, stop ordering packages, or pause cloud spending because of a geopolitical headline.

Second, Trump doesn’t want to tank the stock market.

He treats it like a scoreboard.

And with midterm elections on the horizon, sustained market weakness is the last thing he wants.

That doesn’t mean these moments can’t shake markets in the short term.

They absolutely can.

But these shakeouts are usually emotional first, fundamental second.

And that’s exactly why they’re so valuable for investors who know the playbook.

Headline shock → risk-off selling → panic takes over → dip buyers step in → we recover → new highs.

Yesterday was the risk-off selling.

Pretty soon we’ll hit new highs.

It happens every time.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The Next Warren Buffett (According to Big Short Star)

Posted January 28, 2026

By Davis Wilson

Your Fav Stocks Could Move 15% This Week

Posted January 26, 2026

By Davis Wilson

Moonshots: Ticker: ELON… NAK… FNMA

Posted January 24, 2026

By Davis Wilson

SpaceX, Copper, FNMA + My Answers

Posted January 17, 2026

By Davis Wilson

“sucking wind”

Posted January 16, 2026

By Davis Wilson