Posted January 12, 2026

By Davis Wilson

Trump + Bernie Sanders = RUN!

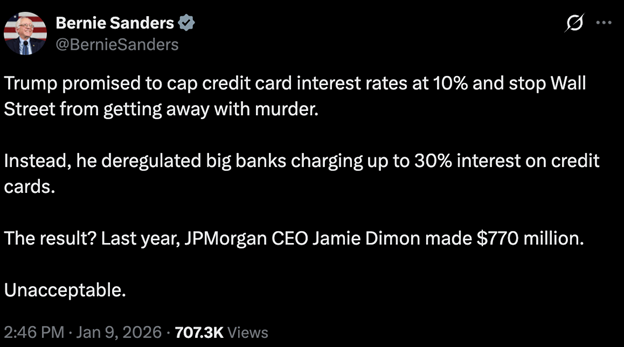

At 2:46 p.m. on January 9, Bernie Sanders fired off a tweet aimed squarely at President Trump:

That same day, Elizabeth Warren added fuel to the fire, saying:

“I said a year ago if Trump was serious I’d work to pass a bill to cap rates. Since then, he’s done nothing but try to shut down the [Consumer Financial Protection Bureau].”

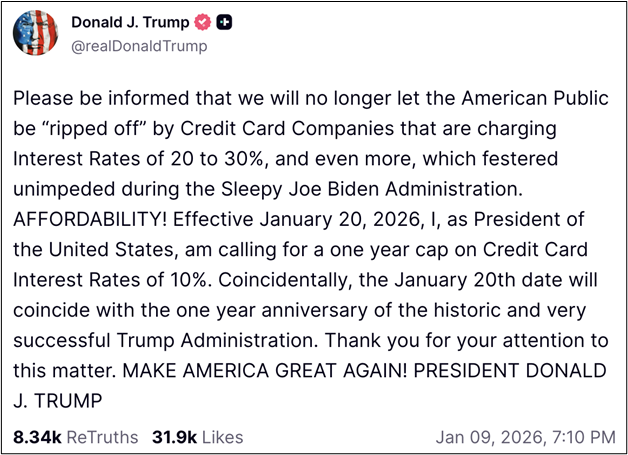

Within hours, President Trump responded on Truth Social:

You can make of the timing what you want.

To me, this looks far more like a political response than a well-thought-out policy decision.

Credit card interest rates currently average around 23%, according to the Federal Reserve.

Interest income is a core profit driver for consumer finance companies.

As expected, the stock market reacted immediately.

As I write this, Capital One (COF) is down roughly 6%. American Express (AXP) is down about 5%. And Synchrony Financial (SYF) is down 8%.

The reaction isn’t complicated.

Lower interest rates charged to cardholders mean lower interest income for these companies.

Not all companies are losers, however.

Retailers like Walmart (WMT), Amazon (AMZN), and Target (TGT) could benefit if consumers face a lower interest burden and have more spending power.

Visa (V) and Mastercard (MA) are far less impacted.

They don’t set interest rates. They earn money by skimming transaction volume.

But that’s not the most important part of this story.

The bigger question is where this ends.

The proposed 10% cap doesn’t exist in isolation.

It’s part of a broader pattern of increasingly interventionist economic policy.

Consider the recent moves and proposals.

- The Justice Department just threatened the Federal Reserve with a possible criminal indictment related to testimony about renovations to the Fed’s office buildings, a move that appears closely tied to Trump’s ongoing clash with Fed Chair Jerome Powell over interest rates.

- Trump has directed Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to push down mortgage rates.

- He has called for an institutional ban on owning single-family homes.

- He has publicly urged the Federal Reserve to cut interest rates to 1% in 2026.

- And Trump has announced $2,000 tariff stimulus checks.

Individually, each of these actions can be framed as helping affordability or the working class.

Taken together, they paint a very different picture.

Just a few months ago, half the country was debating rent caps leading up to Zohran Mamdani getting elected New York City mayor.

The math was clear that rent caps reduce housing supply and ultimately make affordability worse over time.

Now we’re talking about caps on credit card interest rates.

Are these ideas really that different?

They’re both price controls.

They both sound good on the surface.

And they both come with unintended consequences.

If a 10% credit card interest cap were actually enacted (which remains unlikely), banks wouldn’t simply accept lower profits.

They would adapt.

That adaptation would likely include tighter underwriting standards, reduced credit lines, or closed accounts for higher-risk borrowers.

Companies would also look to make up for lost interest income by increasing fees, including annual fees, late fees, or penalty fees.

In other words, access to credit would shrink for many of the very people these policies are meant to help.

Milton Friedman summed this problem up decades ago:

"When government – in pursuit of good intentions – tries to rearrange the economy, legislate morality, or help special interests, the cost come in inefficiency, lack of motivation, and loss of freedom. Government should be a referee, not an active player."

While President Trump’s policies have largely been a net positive for stock market investors, this proposal misses the mark.

And when Bernie Sanders and Elizabeth Warren are applauding a policy, history suggests investors should proceed with caution.

Government intervention in free markets almost always creates more problems than it solves.

This time will be no different.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Elon's "Income Car" Is Here

Posted March 11, 2026

By Davis Wilson

“I Bought the IPO… Then It Collapsed”

Posted March 09, 2026

By Davis Wilson

Mess With the Tesla Bulls, You Get the Horns

Posted March 07, 2026

By Davis Wilson

It's Elon's World, I'm Just Riding In It...

Posted March 06, 2026

By Davis Wilson

8 Stocks to Buy (March 4th, 2026)

Posted March 04, 2026

By Davis Wilson