Posted August 08, 2025

By Davis Wilson

Trump vs. INTC

The CEO of Intel is under fire.

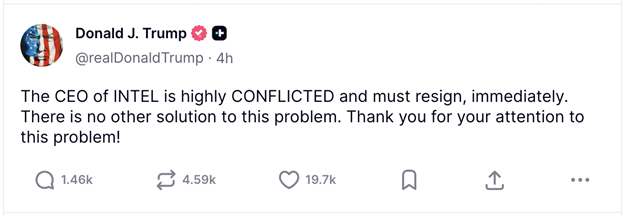

Yesterday, President Trump sent a now-viral post on Truth Social:

Within minutes, Intel’s stock plunged 3%.

But this wasn’t a one-day reaction. Intel shares have already fallen 60% over the last five years.

And this latest news adds even more uncertainty to a company that already has too much of it.

What’s most frustrating is that Intel wasn’t always like this.

For years, it was one of the most dominant chip companies on the planet.

Today? It’s a cautionary tale.

Here’s How Intel Fell Behind

Intel was built on CPUs – central processing units.

These are the chips that power PCs.

Think of a CPU like a head chef in a kitchen: great at managing complex tasks, but not built for multitasking at scale.

For decades, Intel dominated this market.

That was… up until the late 2010s when Intel’s 7nm and 10nm chips faced years of delays.

That left the door wide open for AMD to swoop in.

Now, AMD now holds 25% of the server CPU market – a space Intel once owned almost entirely.

Worse, Intel was so busy playing defense, it missed the next big wave: AI.

While Intel doubled down on CPUs, Nvidia bet everything on GPUs – graphics processing units.

If CPUs are head chefs, GPUs are line cooks.

They’re built for handling thousands of small tasks at once – perfect for training massive AI models.

In the last 5 years, Nvidia is up 1,500%. Intel is down 60%.

That divergence tells you everything you need to know.

In 2021, Intel brought back long-time engineer Pat Gelsinger as CEO.

He had a bold vision: compete directly with Taiwan’s TSMC by becoming a world-class chip manufacturer again.

This was a dramatic shift.

Most of today’s top chip companies (Nvidia, AMD, Broadcom) follow the “fabless” model.

They design chips, but outsource manufacturing to TSMC or Samsung.

Intel wanted to do both.

The idea wasn’t crazy.

Covid-era supply chain issues showed how fragile the global chip network was. And Washington was encouraging companies to onshore manufacturing and reduce dependence on Asia.

Intel even received funding through the U.S. government’s Secure Enclave program – designed to secure chips for national defense.

But good ideas still need good execution.

Intel tried to buy its way into the foundry race by acquiring GlobalFoundries and Tower Semiconductor, but both deals fell through.

That left only one option: spend billions building new factories from scratch.

At the very moment Intel was losing share in its core business, it began racking up unprecedented costs.

Today, Intel is bleeding cash. Revenue is shrinking. Earnings are down. And that once-promising foundry bet may now be getting walked back.

The Bottom Line: Don’t Touch It

This is a controversial opinion here at Paradigm Press.

But I’m an independent investor. And this is my money.

President Trump’s attack on Intel’s new CEO, Lip-Bu Tan, marks just the latest hit for a company already under pressure.

Senators are calling for investigations. Intel says he divested. But it’s another distraction for a company that desperately needs focus.

If you’re looking at the stock, just know that Intel may look cheap.

But it’s not a value stock. It’s a value trap.

It lacks a growth engine. It has no competitive edge in AI. Its leadership is distracted. And its only long-term bet (manufacturing) might be on the chopping block.

Meanwhile, top-tier chip companies like Nvidia (NVDA) and Broadcom (AVGO) are executing flawlessly.

Nvidia is riding the AI wave, with chips that power everything from ChatGPT to autonomous driving.

Broadcom is powering hyperscaler infrastructure with custom ASICs and a strategic acquisition engine that actually delivers.

You don’t need to own Intel here. It’s dead money.

If and when Intel proves it has a strategy and leadership with both vision and clarity – then we can talk.

But for now, better opportunities are passing it by.

Own those instead.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

Why is Bitcoin Falling?

Posted November 24, 2025

By Davis Wilson

Buy Alert: $5,000 NVDA Feb $200 Calls

Posted November 22, 2025

By Davis Wilson

“Smart” People Hate Me…

Posted November 21, 2025

By Davis Wilson

NVDA Earnings 4:20pm!

Posted November 19, 2025

By Davis Wilson

![[13F Drop] What Buffett, Ackman, Burry & Loeb Just Bought](http://images.ctfassets.net/vha3zb1lo47k/5v1FzZivKB3W3UsB2MK6U7/09b4434d129144e2a27e1f7736fde02a/shutterstock_2617089383.jpg)

[13F Drop] What Buffett, Ackman, Burry & Loeb Just Bought

Posted November 17, 2025

By Davis Wilson