Posted July 18, 2025

By Davis Wilson

$UBER is Up 50% – More to Come

Uber Technologies (UBER) is up more than 50% this year.

And yet… I still think it’s early.

Because beneath the surface of Uber’s rideshare and food-delivery empire lies something much bigger – a bet on the future of mobility.

And that future is autonomous.

Uber Wins No Matter Who Builds the Car

Let’s take a step back.

Uber isn’t trying to become the next Tesla or Waymo.

It made a deliberate choice not to spend billions on developing its own self-driving technology – a strategy that’s sunk plenty of deep-pocketed competitors.

Instead, Uber did what it does best: built the marketplace.

Uber is a platform. It matches supply and demand in real time and takes a cut from every ride.

More rides = more revenue = more profit.

That model is supply-led – which means the more drivers (or in this case, vehicles), the more revenue Uber generates.

This same formula works with autonomous vehicles (AVs), too.

Only now, the “drivers” don’t need sleep, health insurance, or surge pricing to show up during rush hour.

With enough supply, the economics only get better.

Uber’s Partnership List Keeps Growing

Instead of reinventing the wheel, Uber has partnered with the companies who already did:

- Lucid Motors: Yesterday, Uber announced a $300 million investment to bring Lucid EVs – specifically, its 450-mile range Gravity SUVs – into Uber’s future AV fleet.

- Baidu: Last week, Uber announced it’s working with Baidu’s Apollo Go platform to launch robotaxis across Asia and the Middle East.

- Waymo: Waymo and Uber already operate its autonomous ride-hailing service in several US cities. The duo also plans to expand its services to Washington D.C. and Miami in the future.

- Nuro: A Level 4 AV startup backed by Google and SoftBank. It’s providing the software brain behind Uber’s future robotaxi fleet.

- WeRide: In the UAE, Uber is teaming up with this Abu Dhabi-based AV firm for 2025 robotaxi deployment.

- Aurora: Uber Freight is integrating Aurora’s autonomous tech for long-haul logistics through 2030.

- BYD: A partnership to electrify Uber’s fleet with 100,000 new vehicles.

This global patchwork of AV alliances does more than reduce capital intensity.

It insulates Uber from technological risk.

It doesn’t matter who wins the AV hardware war.

As long as those cars need rides to fulfill, Uber gets paid.

Here’s Why AV Companies Need Uber

Why would autonomous vehicle makers like Waymo, Baidu, or Lucid partner with Uber instead of launching their own ride-hailing apps?

Simple: Uber already owns the customer.

The app is used by millions across hundreds of cities and has 15 years of ride-level data and a backend built for global scale – optimizing routing, pricing, payments, and safety.

AV companies realize it’s faster and more profitable to tap into Uber’s demand than to spend a decade building their own user base.

That’s why Uber is now the platform of choice for robotaxi integration – from Waymo in cities across the U.S., to Baidu in the Middle East, and now Lucid and Nuro with their global blueprint for scalable AV deployment.

In the deal inked yesterday, Nuro provides the self-driving software. Lucid delivers the long-range EVs. And Uber connects them to real riders.

This isn’t a science experiment. It’s a revenue engine ready to scale.

Uber’s Core Business Is Thriving – and the Upside Is Massive

While robotaxis steal headlines, Uber’s core business is crushing expectations:

- Record profitability

- Expanding margins

- Dominant position in ride-hailing, delivery, and freight

And Uber didn’t make the classic mistake of chasing AV hardware dreams.

It chose to stay capital-light and platform-focused – capturing value from every autonomous ride without burning billions to get there.

AVs are no longer a moonshot.

They're an upside call option on a business that’s already firing on all cylinders.

Uber isn’t just a rideshare app anymore.

It’s a global mobility platform.

A capital-light, data-rich, revenue-scaling juggernaut.

And its stock is still a buy.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

“I’ll Wait for the Dip” – The 5 Most Expensive Words in Investing

Posted July 16, 2025

By Davis Wilson

>>This Week<< The TRUTH Comes Out

Posted July 14, 2025

By Davis Wilson

The Truth About My Trades (and Why I Rarely Make Them)

Posted July 12, 2025

By Davis Wilson

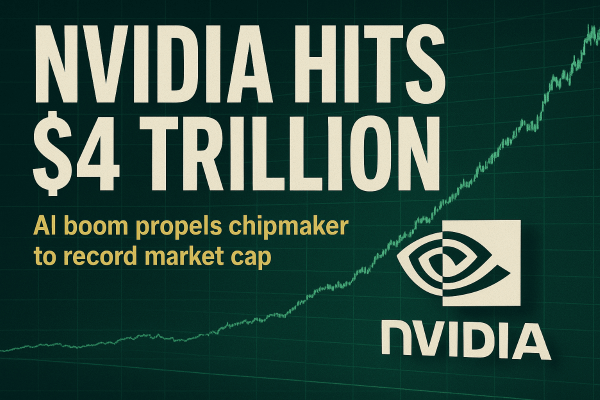

$4,000,000,000,000 – And It’s Still Early

Posted July 11, 2025

By Davis Wilson

The Strange Reason I Own Bitcoin

Posted July 09, 2025

By Davis Wilson