Posted January 26, 2026

By Davis Wilson

Your Fav Stocks Could Move 15% This Week

I cannot overstate how important earnings season is.

Every few months, Wall Street enters a frenzy.

Stocks make double-digit moves overnight.

Fortunes are made (and lost) in the blink of an eye.

And this week, some of the biggest companies in the world report earnings.

Some of their stock prices will spike higher… while others will plummet lower.

Let me explain.

What Is Earnings Season?

Earnings season occurs four times a year – typically beginning a few weeks after the end of each quarter.

This is when publicly traded companies report their financial results, detailing revenue, earnings, profit margins, and future outlooks.

Investors eagerly anticipate these reports because they provide critical insights into a company’s health and industry trends.

Earnings season matters because it’s one of the few times a year when traders get a reality check.

Hype and speculation dominate the stock market in between earnings reports, but when companies release actual numbers, the truth comes out.

Here’s why it’s such a big deal:

- Volatility Creates Opportunity: Earnings season injects massive volatility into the market. A company that beats expectations can see its stock price skyrocket overnight, while a weak report can send shares into a nosedive.

- Expectations vs. Reality: The market doesn’t just react to earnings. It reacts to expectations. A company might post solid results, but if Wall Street expected even better, the stock could still drop. Conversely, a company reporting mediocre earnings might still rally if investors feared worse. Understanding this dynamic is key to making money during earnings season.

- Guidance Moves Markets: Earnings reports aren’t just about past performance. Companies provide forward guidance – forecasts for revenue, earnings, and business conditions. This guidance often has a bigger impact on stock prices than the actual earnings results. A company that beats earnings but lowers its future outlook can see its stock plummet, while a company with weak earnings but strong guidance can rally.

- Sector Trends Are Revealed: Earnings season gives investors a real-time pulse on different industries. If multiple semiconductor companies report strong demand, it signals strength in the tech sector. If major retailers struggle, it might indicate consumer spending is slowing. These insights help traders position themselves for broader market trends.

Here’s What to Watch This Week

Some of the biggest companies in the world report their financial results this week.

Here’s the full calendar:

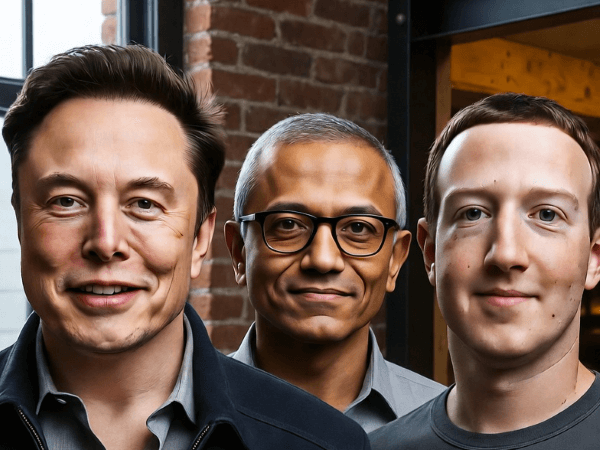

We’ll hear from tech companies like Microsoft, Meta, Apple, Tesla, and ASML, but also major bellwethers like Visa, Mastercard, AmEx, UPS, General Motors, Boeing, Caterpillar, ExxonMobil, Chevron, IBM, ServiceNow, and Comcast/Charter.

Tune in this week for answers to questions like:

What’s the status of the AI “Bubble?” – Microsoft, Meta, and Tesla are all leaders in AI. And companies like ASML and Lam Research make the equipment used to manufacture semiconductors. Let’s see what they have to say about demand.

What’s the latest on the US energy buildout? – GE Vernova, ExxonMobil, Chevron and others report this week at a time when the US energy grid is under a microscope. So far, it’s held up well through the cold front. But the bigger question is what happens when hundreds of new data centers come online and demand ramps even higher.

What’s Visa, AmEX, and Mastercard’s thoughts on a 10% rate cap? – President Trump recently threatened a 10% cap on credit card interest rates. Are Visa, AmEx, and Mastercard’s businesses in danger? Or was the sharp selloff in their stocks overdone?

How are Gov't Contractors impacted by Trump's Executive Order? – A new Executive Order prohibits underperforming defense contractors from conducting stock buybacks or issuing dividends. How are companies like Boeing, Lockheed Martin, Northrop Grumman, and General Dynamics impacted? Find out this week.

Again, I cannot overstate how important earnings season is.

If you’re invested in any stocks that report this week, don’t be surprised when you see their stock prices move sharply higher or lower.

I recommend reading their respective press releases and also reading their earnings call transcripts.

Of course, you can also just stick with The Million Mission as I’ll be tracking the latest developments.

Look for a full rundown of the week’s action in a few days.

Sign Up Today for Free!

Davis Wilson is attempting to make $1 Million in the stock market.

He’s starting with just $100,000.

That’s a 10X return on his money.

And the best part… He’s going to be closely documenting his journey for you to follow along – full transparency.

You can follow along by signing up for The Million Mission absolutely free.

His high risk/high reward alerts will be delivered straight to your inbox.

That means…

- You’ll know exactly what Davis is investing in throughout his journey…

- You’ll know his immediate thoughts on breaking news that can impact his (and your) portfolio…

- And you’ll get the opportunity to follow along in your own portfolio (Up to you!).

Look for these alerts on Monday, Wednesday, and Friday to start, with an “Ask Davis” email on Saturday where he’ll respond directly to reader questions and feedback.

Inside each weekday alert, you'll find timely insights and investing opportunities that Davis is targeting in his own portfolio.

These will range from AI plays to cryptocurrencies to consumer staples.

No stocks or strategies are off limits for this audacious goal.

Can he pull it off?

Enter your email below to find out.

The Wilson Family's WORST Investment Mistake

Posted February 02, 2026

By Davis Wilson

META⬆️MSFT⬇️TSLA⬇️

Posted January 30, 2026

By Davis Wilson

Moonshots: Ticker: ELON… NAK… FNMA

Posted January 24, 2026

By Davis Wilson

Ticker Symbol: ELON… Coming Soon

Posted January 23, 2026

By Davis Wilson

T.A.S.M. (Trump Always Scares Markets)

Posted January 21, 2026

By Davis Wilson